PricePedia Scenario for March 2025

Higher uncertainty undermines the recovery of global demand and increases the downside risk of commodity prices

Published by Pasquale Marzano. .

Forecast Forecast

The PricePedia Scenario has been updated with information available as of March 6, 2025. The increasing trade tensions between the United States and its main partners, and the resulting higher uncertainty, are negatively affecting global demand for commodities (for an analysis of the latest developments, see Trump under exam: markets send signals of distrust).

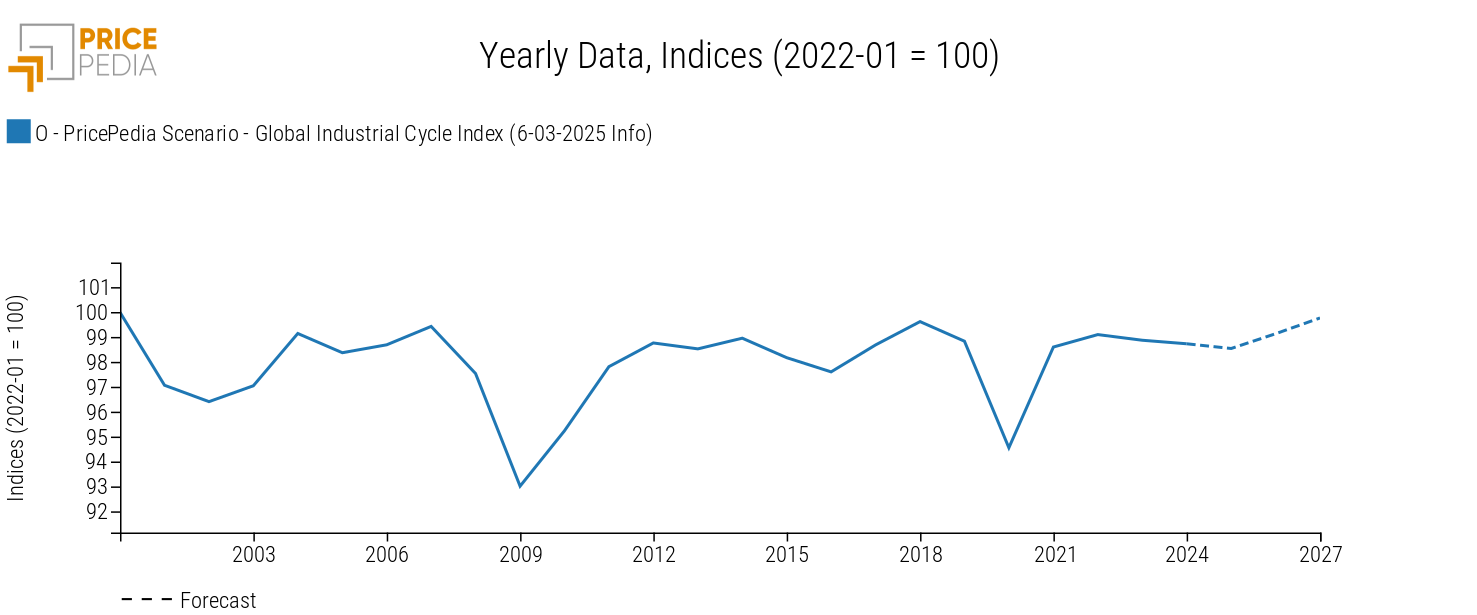

This implies a weaker-than-previously-expected recovery of global manufacturing[1]. Considering the global industrial production index, which represents worldwide demand for manufactured goods, an average annual growth of less than +2% is projected for the 2025-2026 period. This also results in a less dynamic trend for the global industrial cycle index[2], which mirrors industrial production performance.

Global Industrial Cycle, March 2025 Scenario

In terms of the global balance between commodity supply and demand, 2025 is also expected to see a decline of -0.2%, continuing the downward trend that began in 2023.

Forecasts for 2026 have also been revised downward, with commodity demand expected to exceed supply by only 1%, down from the previous scenario (+1.4%). Moreover, most risks are now linked to a deterioration of the international environment, and consequently, the continuation of an oversupply situation in commodity markets.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Forecast for Procurement Material Prices

The worsening scenario for the global industrial cycle suggests continued weakness in global commodity demand in 2025. As a result, price support is expected to be weaker over the next two years.

The following table shows the annual price variations in euros for the main commodity groups (Industrial[3], Commodity[4], Energy, and Food).

| 2023 | 2024 | 2025 | 2026 | |

|---|---|---|---|---|

| I-PricePedia Scenario-Commodity Index (Europe) (6-03-2025 Info) | −18.24 | −4.50 | −1.56 | −1.64 |

| I-PricePedia Scenario-Industrials Index (Europe) (6-03-2025 Info) | −13.81 | −4.36 | +0.87 | +2.05 |

| I-PricePedia Scenario-Energy Total Index (Europe) (6-03-2025 Info) | −23.88 | −5.93 | −6.28 | −4.97 |

| I-PricePedia Scenario-Food Total Index (Europe) (6-03-2025 Info) | −5.47 | +2.95 | +12.95 | −1.94 |

In 2025 and 2026, commodity prices in euros are expected to decline by approximately -1.6% annually, confirming the downward trend in place since 2023.

A similar trend is expected for energy raw materials, although at more negative rates than the Commodity index, with -6.3% and -5% declines in 2025 and 2026, respectively. Within this category, a key trend is the price of European natural gas, expected to increase on an annual average in 2025, though with a decreasing profile starting in March. In recent weeks, diplomatic developments related to the Russia-Ukraine conflict, particularly talks between the US and Russia, have fueled optimism about the war's end and prospects for a greater gas supply in Europe, pushing the price below 50 euros/MWh.

Unlike energy raw materials, industrial commodity prices are expected to show a slight upward trend over the next two years, with 2025 revised downward to below 1%. Meanwhile, the price trend for 2026 remains unchanged, with a projected +2% increase.

As for food commodity prices, they are expected to grow by +13% in 2025, mainly driven by tropical goods. However, this increase is largely due to gains already recorded between late 2024 and early 2025 in financial markets. The recent weakness in tropical food prices in financial markets will likely impact customs prices in the coming months, leading to a lower average index level in 2026.

1. See PricePedia Scenario for February 2025.

2. The global industrial cycle index is constructed by purifying the actual dynamics of industrial production from its trend. Since the supply of commodities tends to vary according to long-term economic growth expectations, while the demand for commodities is more linked to actual cyclical uses, the global industrial cycle index tends to reproduce the conditions of tension between demand and supply on the commodity market: when it increases, it means that the demand for commodities increases more than the supply; vice versa when it decreases.

3. The PricePedia Industrials index results from the aggregation of the indices relating to the following product categories: Ferrous, Non-Ferrous, Wood and Paper, Chemicals: Specialty, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers and Textile Fibres.

4. The PricePedia Commodity index results from the aggregation of the indices relating to industrial, food and energy commodities.