Cost Pass-Through Along the Supply Chain of Propylene Chemical Intermediates

How Propylene Price Variations Affect Derivative Prices

Published by Luigi Bidoia. .

Organic Chemicals Cost pass-throughAfter ethylene, propylene is the main building block of the petrochemical industry, used in the production of polymers, solvents, and chemical intermediates for a wide range of industrial and consumer applications.

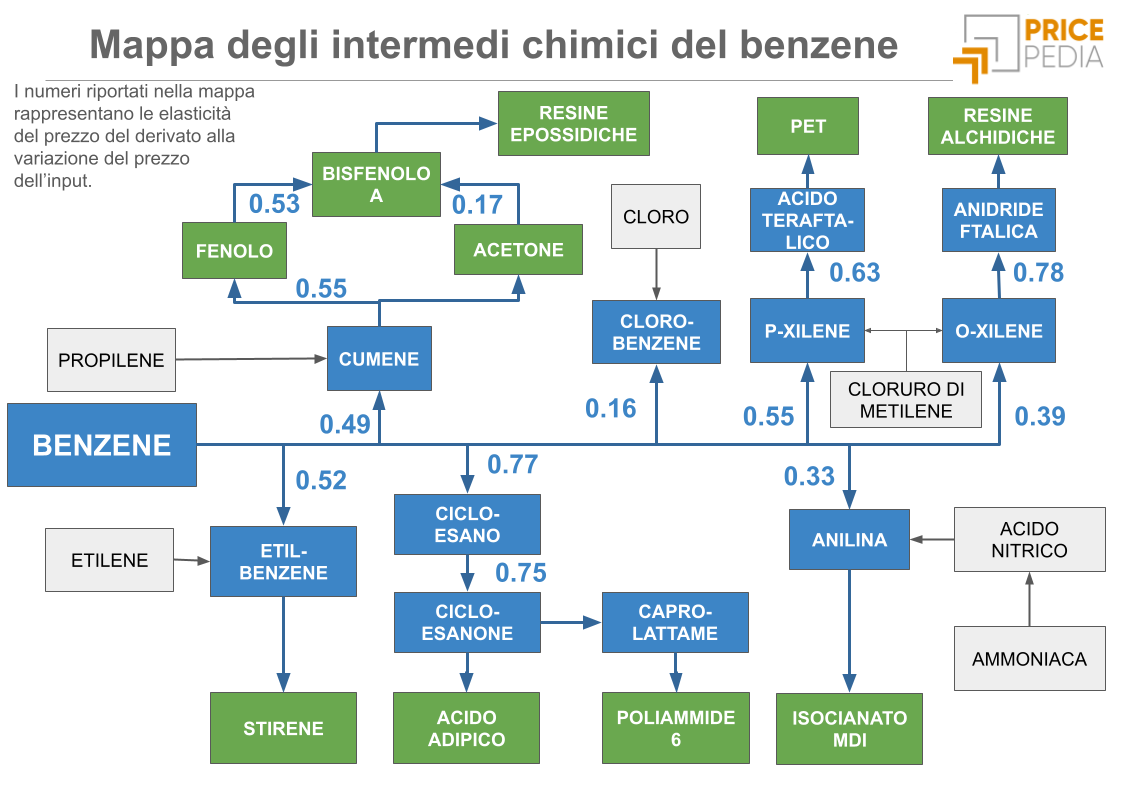

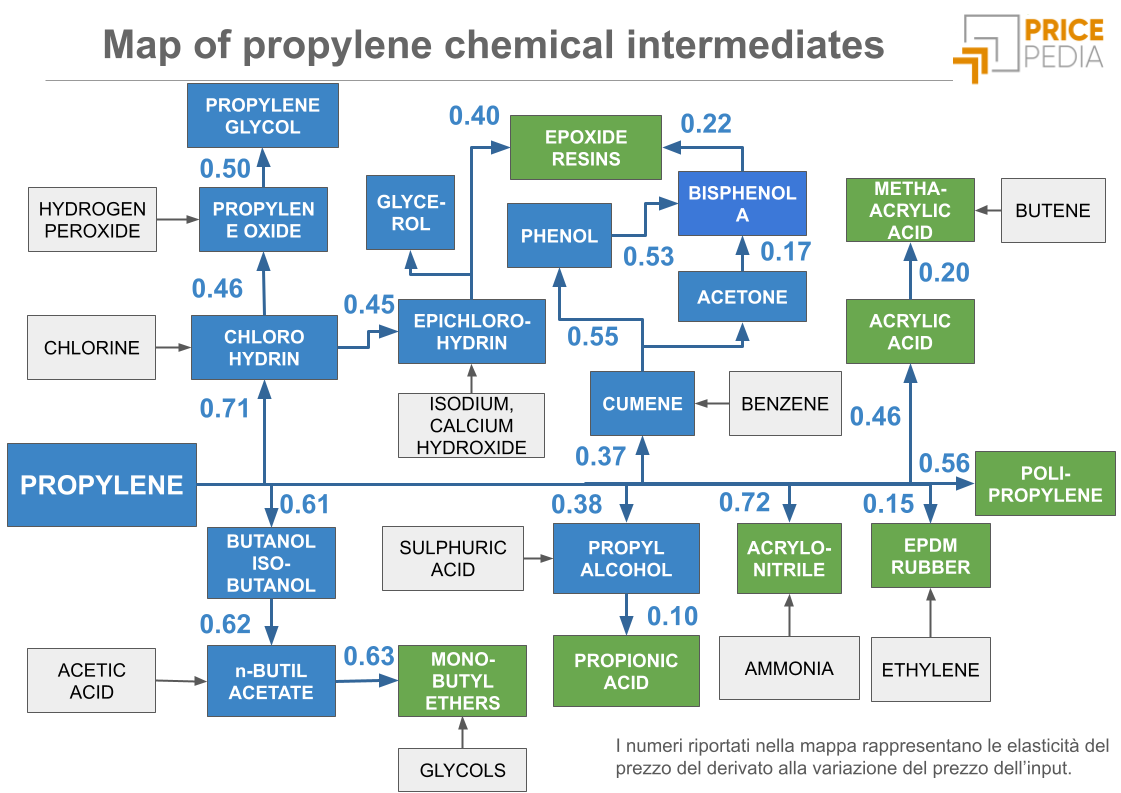

The following figure illustrates the supply chain map based on propylene as the primary raw material. Its most significant use is as a monomer for polypropylene production. Additionally, propylene plays a crucial role in the synthesis of various alcohols and ethers (butanol, propanol, propylene oxide) as well as phenols and ketones (bisphenol A, acetone) and other compounds, which serve as key chemical intermediates in many industrial processes.

Propylene prices are highly volatile, significantly impacting the prices of its derivatives. This article presents the findings of an analysis on how fluctuations in propylene prices are transmitted to the prices of derivative products. This phenomenon is widely known in economic market literature as cost pass-through.

The results are obtained through the estimation of models with a dynamic specification and expressed in terms of the long-term price elasticity of the derivative relative to changes in propylene prices. This elasticity value is shown at the intersections of the different products in the propylene chemical intermediates map illustrated above.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Propylene Price Volatility

The high volatility of propylene prices is driven by several factors, particularly those related to its supply. The most significant include:

- Dependence on non-dedicated production processes: Propylene is often a byproduct of industrial processes such as steam cracking and fluid catalytic cracking (FCC) in refineries. Since these processes are optimized primarily for the production of other products (ethylene in the first case, gasoline in the second), propylene production is rigid and less adaptable to fluctuations in demand.

- Costs strongly linked to crude oil and natural gas prices: Price fluctuations in crude oil and natural gas directly affect propylene production costs, making it highly sensitive to energy market dynamics.

- Strong market regionalization due to high transportation costs: At ambient temperature and atmospheric pressure, propylene exists in a gaseous state and can only be transported via specialized pipelines. For long-distance transportation, it must be liquefied through cooling or pressurization. While its liquefaction process is similar to that of natural gas, it requires less extreme temperatures.

Regionalization of the Global Propylene Market

The high regionalization of the global propylene market is evident from the limited trade volumes between countries. Despite a global production estimated at over 80 million tons, international propylene trade in 2024 amounted to just 5.5 million tons, marking a significant decline from 7.7 million tons in 2017.

In particular, the majority of trade flows are concentrated along specific regional routes, including:

- Exports from South Korea, the world's largest exporter, and Japan, the third-largest exporter, which are directed almost exclusively to China and, to a lesser extent, Taiwan.

- Gaseous propylene flows transported through the pipeline connecting the Netherlands, Germany, and Belgium.

- U.S. imports from Canada and exports to Mexico and Colombia.

Cost Pass-Through of Propylene Prices

The economic theory of cost pass-through examines how increases in input costs are transmitted to output prices. This transmission can vary in both intensity and speed. The intensity of the pass-through is measured by the long-term elasticity of output prices in response to changes in input prices. This elasticity is represented in the propylene intermediates map, at the intersections between input and output prices.

For example, the elasticity between propylene and polypropylene prices is 0.55. This means that a 10% increase in propylene prices, in the long run, will tend to result in a 5.5% increase in polypropylene prices.

The level of long-term elasticity between input price variations and output price changes primarily depends on two factors:

- Cost incidence of the input on the output value: The higher the share of input costs in the final price, the greater the elasticity, all else being equal.

- Degree of output product differentiation: Economic literature suggests that the higher the degree of product differentiation, the lower the elasticity of output prices to input price changes.

In the map above, the highest elasticity is observed in the relationship between propylene and acrylonitrile prices, at 0.72. This high value is consistent with both the significant share of propylene costs in acrylonitrile production and the limited differentiation of the product, which primarily occurs through additional services.

Conversely, the lowest elasticity, among products in which propylene is directly involved in the production process, is found in the case of EPDM rubber (Ethylene Propylene Diene Monomer). This material has a high degree of differentiation: manufacturers develop different EPDM variants tailored to specific industrial requirements, adjusting the composition of monomers and chemical-physical properties. Moreover, in almost all formulations, the percentage of propylene used is significantly lower than that of ethylene. In this case as well, the estimated elasticity aligns with both the share of input costs in production and the degree of differentiation in the final product.

Cost Pass-Through along the Value Chain

The map also includes the elasticities related to the use of propylene-derived products in the production processes of other chemical intermediates, where propylene plays a crucial role, albeit indirectly. One example is n-butyl acetate, which is obtained by combining butanol and acetic acid.

When the relationship between propylene prices and a chemical intermediate is indirect (as in the case of n-butyl acetate), the effect of propylene price fluctuations on the intermediate’s price can be estimated by multiplying the different price elasticities along the production chain. In this specific case, the price elasticity of n-butyl acetate with respect to propylene is 0.37 (0.61 × 0.62). This means that, under stable conditions, a 10% increase in the price of propylene would, in the long run, lead to a 3.7% increase in the price of n-butyl acetate.

An extreme case is represented by propionic acid, whose price exhibits very low elasticity to propylene prices, below 0.05%. The production of propionic acid from propylene follows an indirect pathway, passing through propanol formation and requiring the use of specific catalysts at each stage of the process. This significantly reduces the impact of propylene costs on the final price of propionic acid. Additionally, there are biotechnological and chemical alternatives (ethylene-based) that provide different production routes, which may be more cost-effective depending on economic factors and sustainability goals.

Conclusions

Propylene is a fundamental raw material for the chemical industry, used in numerous production processes. Variations in its price tend to influence, through production costs, the prices of derivative products. A key measure of these effects is the long-term price elasticity of the output relative to changes in the input price.

By estimating and analyzing these elasticities, it is possible to quantify the impact of propylene prices not only on directly derived compounds but also on chemical products further downstream in the production chain. This approach helps to better understand cost transmission dynamics along the value chain and to assess more accurately the economic implications of raw material price fluctuations.

The cost pass-through theory provides an essential analytical framework for studying these price transmission mechanisms along production chains. It is an indispensable tool both for the historical interpretation of market dynamics and for forecasting future price trends in the commodity sector.