Price differentiation along the packaging paper supply chain

The case of multilayer paperboard

Published by Pasquale Marzano. .

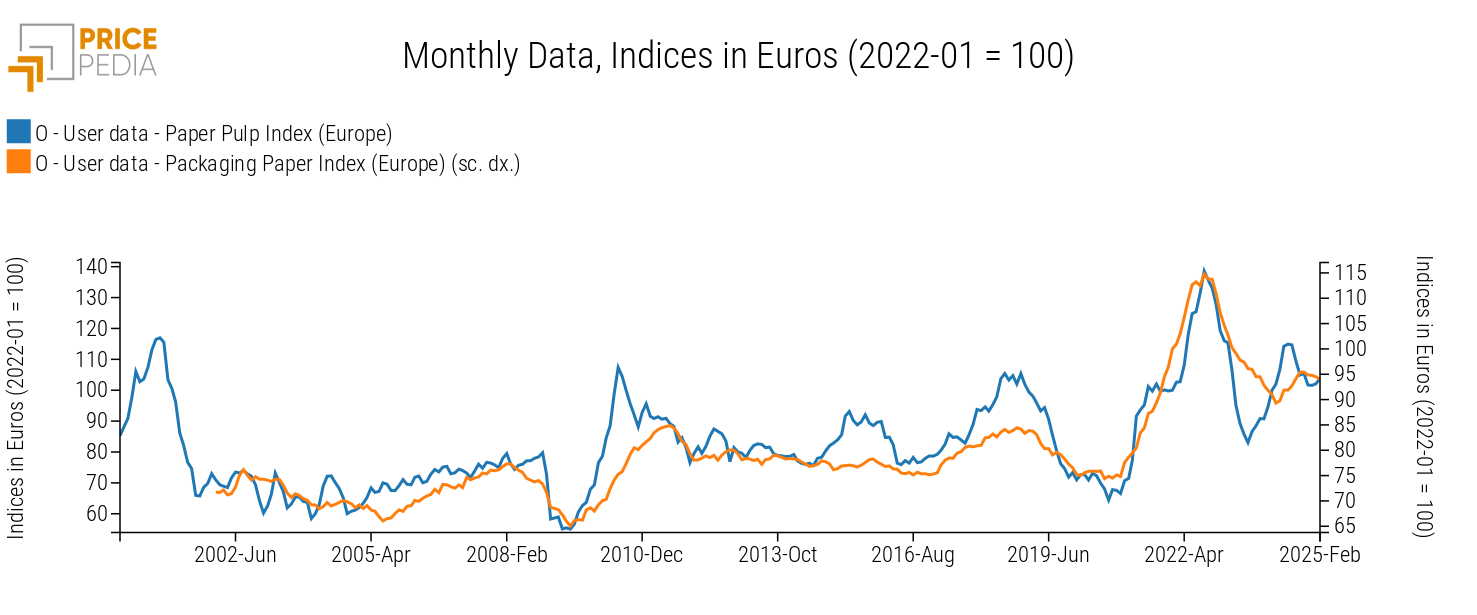

Wood and Paper Packaging Paper Analysis tools and methodologiesThe post-pandemic phase has been characterized by a strong price cycle for paper pulp, which has been reflected in the production costs of the paper industry. Considering the prices of the main paper pulps used by the European paper industry, they recorded an average increase of over +60% in the 2021-2022 period, followed by a subsequent decrease of -21% in 2023. This dynamic of increase and subsequent reduction in the primary input has been transferred to the average prices of packaging paper.

The following chart compares two aggregated indices referring to input and output prices along the packaging paper supply chain.

Input vs. Output: Prices along the packaging paper supply chain, Indices in € (2022-01=100)

The chart shows that, in the long run, packaging paper prices follow the trend of paper pulp prices. However, the greater differentiation of packaging paper results in a higher price stickiness[1].

This is evident in the 2021-2022 price increase cycle and, above all, in the 2023 decline phase, where packaging paper prices fell by -9.8%, compared to the -20% drop in paper pulp prices.

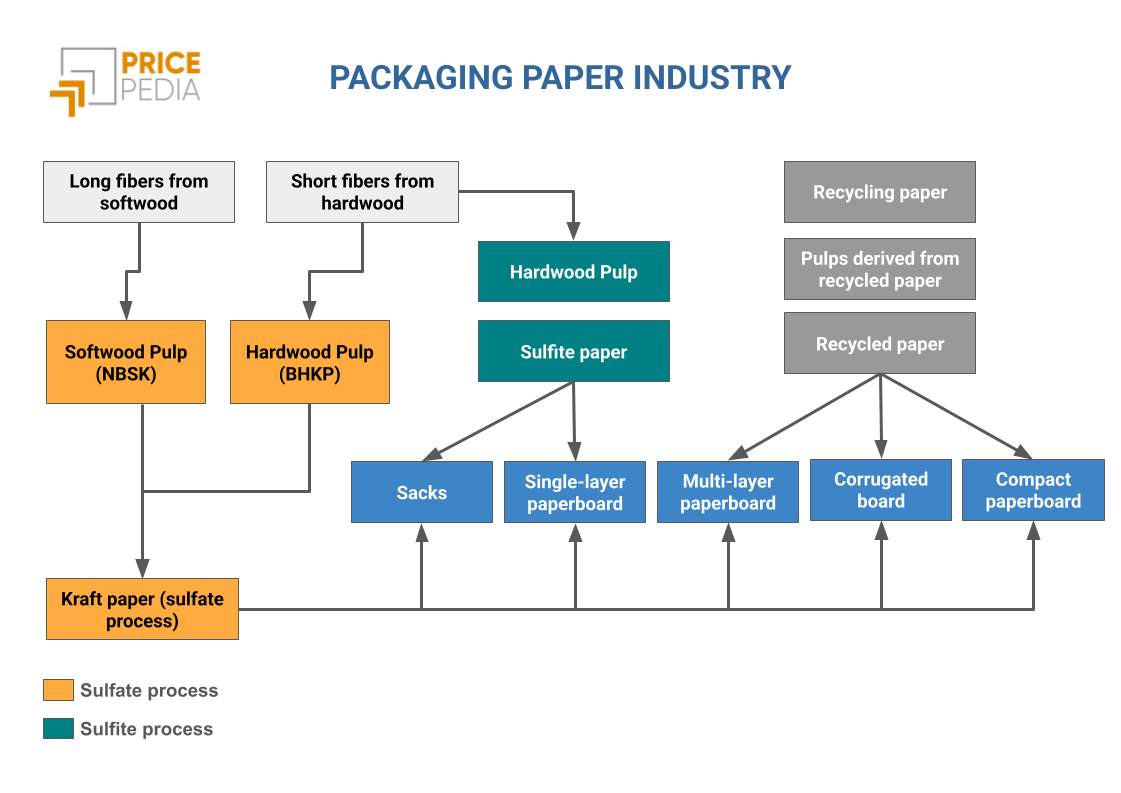

The following reference scheme is the one used in PricePedia to analyze the relationships between the prices of various commodities that make up the packaging paper industry.

The diagram represents the production cycle of packaging paper, highlighting the different transformation processes of raw materials, starting upstream with wood long and short fibers and recovered paper, and ending downstream with the final products used for packaging (sacks, paper and paperboard).

The main chemical process is the sulfate process (highlighted in orange), which produces Kraft paper with high mechanical properties, followed by the sulfite process (highlighted in green), which allows for lighter and less resistant papers.

Depending on characteristics and uses, final products can be made from varying percentages of paper from virgin and recycled fibers, sometimes leading to a very high product differentiation.

The Case of multilayer paperboard

Among the downstream products of the packaging paper supply chain, multilayer paperboard is emblematic of product differentiation.

There are several product types that differ based on fiber composition and surface treatments.

The Combined Nomenclature[2] classifies products based on whether or not the different layers are bleached[3].

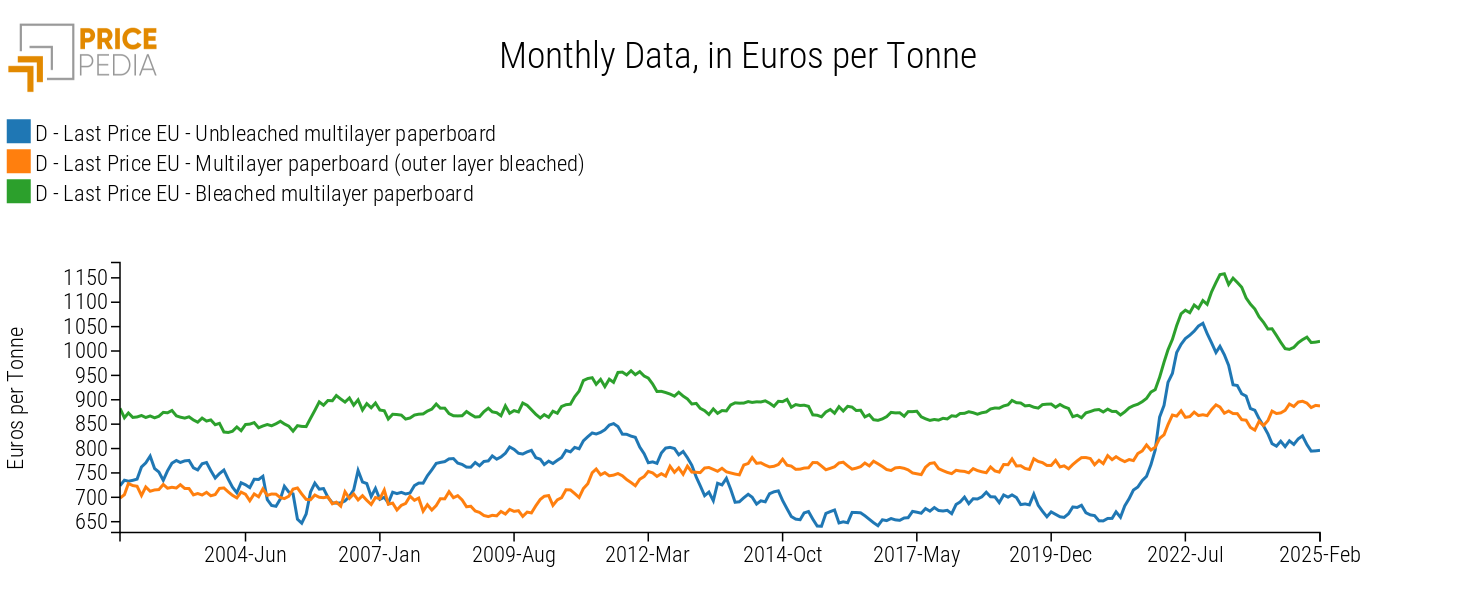

The following chart shows the European customs prices of coated multilayer paperboard, expressed in euros per ton.

European Prices of Multilayer Paperboard, in €/Ton

The chart shows a common trend in the prices of Unbleached multilayer paperboard and Bleached multilayer paperboard, consistent with the overall trend of packaging paper.

Additionally, considering price levels, bleached multilayer paperboard has a positive price differential compared to unbleached paperboard, in line with the higher costs associated with the bleaching process.

Regarding the product referred to here as "multilayer paperboard (outer layer bleached)", its price trend appears less volatile, indicating a greater market power of companies and, consequently, a higher degree of product differentiation compared to the other two types of paperboard.

This aligns with the fact that this product type is mainly used in food and beverage packaging, requiring additional processing that includes the application of metallic or plastic materials to the inner paper surface to make it resistant to liquids.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

The higher degree of differentiation of European multilayer paperboard (outer layer bleached) is also observable by distinguishing the EU price between intra-EU trade and extra-EU imports.

Multilayer paperboard (outer layer bleached): Intra-EU Price vs. Extra-EU CIF Price, in €/Ton

The comparison highlights the uniqueness of the European product, with the intra-EU price generally exhibiting higher but more stable levels than the extra-EU CIF price.

In particular, stability characterized the intra-EU price during the 2021-2022 price increase cycle, amid rising demand for packaging paper. Over the same period, the extra-EU CIF price experienced increases exceeding +50%, in line with cost dynamics driven by paper pulp prices.

Conclusions

The theory of cost pass-through is an important tool for analyzing how variations in input prices are transferred to output price changes.

According to this theory, the percentage of cost variation passed on to sales prices tends to decrease as product differentiation increases. The case of the product referred to as multilayer paperboard (outer layer bleached) particularly seems to confirm this theoretical aspect. This product is highly specific in its applications and, therefore, highly differentiated from other multilayer paperboards. Consequently, its price trend during the recent commodity price cycle has been much stickier than that of other multilayer paperboards.

1. See the in-depth analysis Properties of Commodity Markets and Price Variability.

2. The Combined Nomenclature is the classification used by the EU to collect customs declarations from European firms.

3. The codes for coated multilayer paperboard are CN481092.10 (all layers bleached), CN481092.30 (outer layer bleached), and CN481092.90 (no bleaching).