Ethylene: Price Dynamics and Competitive Advantage Between the US and Europe

How energy costs, market regionalization, and industrial strategies shape the pricing of ethylene and its derivatives

Published by Luigi Bidoia. .

Organic Chemicals Cost pass-throughWith an annual production exceeding 150 million tonnes, ethylene is the primary building block of the petrochemical industry. The ethylene market shares many characteristics with that of propylene[1], including:

- costs that are highly dependent on energy raw material prices;

- strong market regionalization, due to high transportation costs.

Cost Dependence on Energy Prices

The production cost of ethylene is closely tied to energy prices, as its manufacturing process relies primarily on a derivative of either crude oil or natural gas. Ethylene is produced through steam cracking, using feedstocks such as virgin naphtha—derived from crude oil distillation—or ethane, obtained by separating it from methane and other gases present in natural gas.

Production costs therefore depend heavily on the type of feedstock and its local availability, especially in the case of ethane. The availability of ethane is, in turn, linked to the availability of low-cost natural gas. In this context, the United States enjoys a significant advantage thanks to the fracking technique, which enables the extraction of large quantities of shale gas, rich in ethane.

This cost advantage can be assessed by comparing the level and trend of U.S. ethylene export prices with the import prices of the EU and China.

Comparison of ethylene prices in different markets around the world

As shown in the graph above, the FOB price of U.S. ethylene exports is significantly lower than the CIF price of Chinese and, especially, EU imports. This gap is partly explained by transport and insurance costs (reflected in the difference between CIF and FOB prices), but it also highlights the competitive advantage enjoyed by chemical companies located in the United States.

Market Regionalization

Out of the approximately 150 million tonnes of ethylene produced globally each year, less than 10 million tonnes are traded internationally. Most of this volume comes from exports by South Korea and Japan to China, as well as from the Netherlands and the United Kingdom to Belgium and Germany. The only country that exports ethylene to a broad range of destinations is the United States, whose export markets include not only China, Indonesia, Argentina, and Pakistan, but also several EU countries such as Belgium, Portugal, France, Germany, and Italy.

The cost advantage enjoyed by U.S.-based companies is further confirmed by their growing share of global demand: U.S. ethylene exports increased from just a few thousand tonnes before 2015 to over one million tonnes by 2022.

However, American ethylene exporters are not only competing with other exporting countries. They also face competition from downstream companies that choose to produce ethylene in-house through steam cracking of virgin naphtha. This is especially relevant in the European chemical industry, where companies often prefer to import virgin naphtha and produce ethylene domestically. This approach is generally seen as more cost-effective, flexible, stable, and compatible with existing cracking facilities.

Ethylene Price Cost Pass-Through

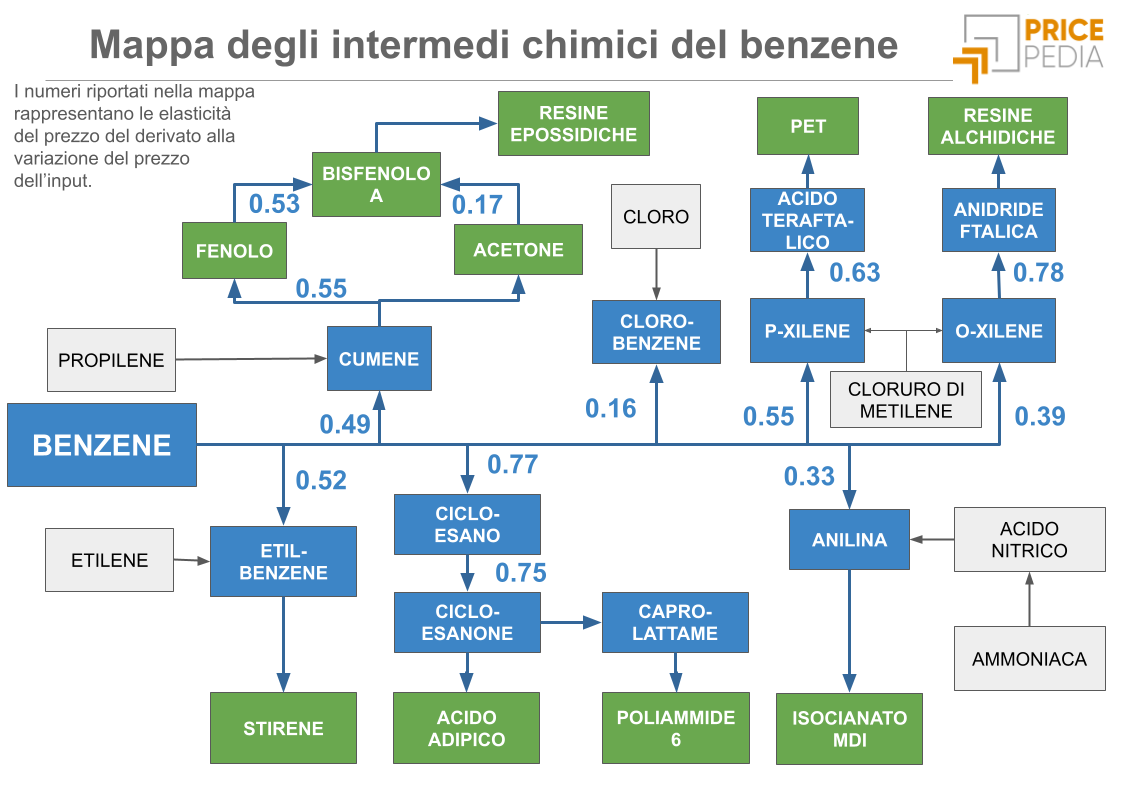

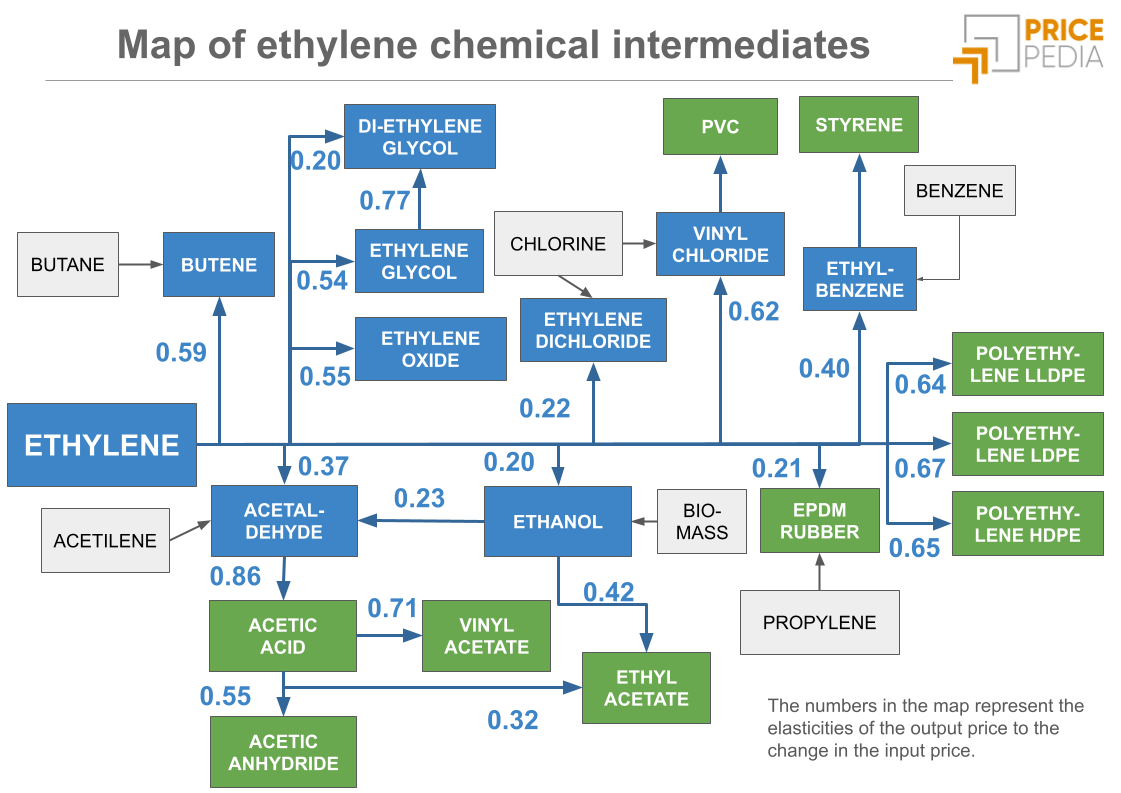

As previously done for propylene[1], the following chart illustrates the production relationships between ethylene and its main derivatives. It should be noted that this is a simplified representation, as many of the chemical products shown can be produced through multiple alternative processes. The relationships included here reflect those most relevant within the European market context.

The relevance of the various relationships between ethylene and its derivatives was assessed based on the statistical robustness of regression models describing the cost pass-through between the price of ethylene and the prices of the chemical compounds considered. The intensity of the pass-through is expressed by the price elasticity of the compound in response to changes in ethylene prices. These elasticities are shown in the ethylene intermediates map, at the intersection points between input and output prices.

For example, the price elasticity of butene with respect to ethylene is 0.59. This means that, all else being equal, a 10% change in ethylene prices tends to result in a 5.9% change in the price of butene.

On average, price elasticities with respect to ethylene are relatively high, except in the cases of ethanol and EPDM rubber. For ethanol, the limited price transmission is due to competition from ethanol produced from biomass: the high substitutability between the two types of ethanol constrains their prices to remain aligned, thereby limiting the extent to which the price of ethylene-based ethanol can vary in response to ethylene price changes.

A similar mechanism applies to EPDM rubber, where prices are influenced by competition from natural rubber and other synthetic rubbers made through alternative formulations. In both cases, substitution effects create a ceiling on price differentiation.

It is also worth noting the relatively high and consistent elasticity values that characterize the relationship between ethylene prices and those of the main ethylene-based polymers. All else being equal, a 10% change in ethylene prices tends to result in a price variation of around 6.5% for low-density polyethylene (LDPE), linear low-density polyethylene (LLDPE), and high-density polyethylene (HDPE).

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Conclusions

Ethylene is the most important building block of the petrochemical industry. Being a gas, it must be cooled to -104°C to be liquefied. Without a dedicated pipeline network, transportation costs are therefore relatively high, limiting international trade. The United States is the only country with a sufficiently strong cost advantage in producing ethylene from ethane to make large-scale exports feasible across multiple global markets.

Changes in ethylene prices tend to be transmitted to the prices of its derivatives, although the transmission mechanisms are complex and strongly influenced by the specific characteristics of each market. Only a detailed understanding of these peculiarities allows for accurate assessment of how shifts in regional ethylene markets will affect derivative prices, which are often subject to unified global price dynamics.

[1] See the article Cost Pass-Through Along the Supply Chain of Propylene Chemical Intermediates