Ferritic coils: the cost pass-through of input prices

Prices of extralega and steel charge have similar effects

Published by Luca Sazzini. .

Ferrous Metals Stainless Steel Cost pass-throughIn last week’s article Cost pass-through of hot-rolled austenitic coil prices , an analysis was carried out on the cost pass-through of austenitic coil prices to verify whether the transfer of prices from production inputs to the final price was consistent with their actual impact on costs. The analysis showed that the long-term elasticity between the prices of austenitic coils and the cost of the AISI 304 alloy is twice as high as that related to the steel charge, a result that appears lower than their incidence in production costs. On average, in fact, the cost of alloys in an austenitic coil accounts for more than half of total production costs.

This article analyzes the cost pass-through of hot-rolled ferritic stainless steel coil prices, following a similar approach to the one used for austenitic coils. Unlike the latter, which are characterized by a high nickel content that can exceed 20%, ferritic coils have an extra-alloy component made almost exclusively of chromium, with a nickel content of zero or less than 1%. This difference in chemical composition is also reflected in the price dynamics and levels of the two specific types of stainless steel coils.

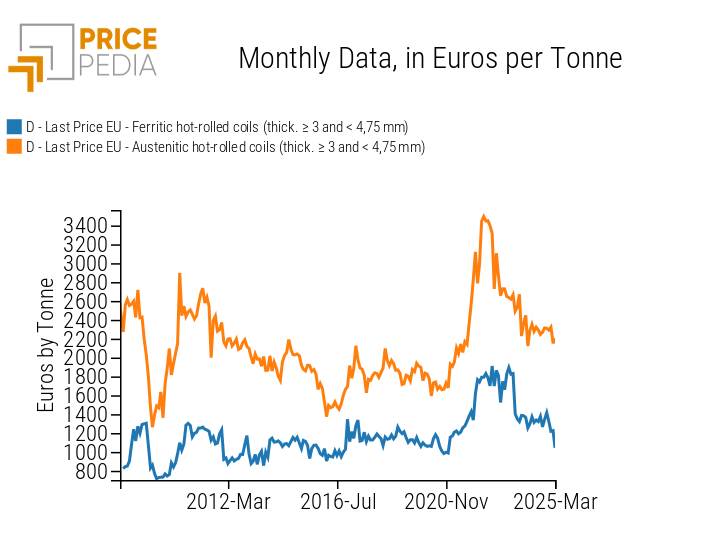

The chart below shows a comparison between the price dynamics of ferritic and austenitic coils, both with a thickness between 3 and 4.75 mm.

Comparison between hot-rolled ferritic and austenitic coil prices

Ferritic coil prices tend to be about half those of austenitic coils and follow different price dynamics, characterized by lower volatility and greater stickiness, especially during downward price phases. This aspect is particularly evident in the analysis of the most recent price cycle. Austenitic coils, after increasing by 46% in 2022, compared to 35% for ferritic coils, experienced a price reduction of -20%, five times greater than that recorded for ferritic coils (-4%).

For the cost pass-through analysis of ferritic coils, we will apply the same methodology already used for austenitic coils, using the statistical regression method to estimate the impact of various production input prices on the final price of ferritic coils.

Econometric model

The dependent variable of the regression model used for this analysis is the Principal Component (PCA) of ferritic coil prices of different thicknesses. This variable makes it possible to capture the common price levels and dynamics across the various types of ferritic coils in a single dependent variable.

The explanatory variables chosen as regressors are:

- the prices of stainless steel scrap with nickel content < 8%: the main input for producing ferritic coils;

- the National Single Price (PUN) from GME: used as a proxy for the cost of electricity needed to melt the stainless steel scrap using the electric arc furnace;

- the extra-alloy AISI 430 cost per ton of steel: which includes the chromium used as an extra-alloy component in the production of ferritic steel;

- the euro area consumer price index: used as a proxy for labor and service costs employed in the production process, assuming both are indexed to inflation;

- the euro area industrial cycle index: used as a proxy for the dynamics of European market demand.

To account for the time-lagged effect of changes in ferritic coil prices, lags were added to the explanatory variables of PUN and stainless steel scrap prices (with nickel content below 8%), since these impacts generally manifest only after a certain time interval. In addition, to interpret the estimation results in terms of elasticity, the logarithmic transformation was applied to all variables.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Long-run regression

The following table shows the long-run estimation results of ferritic coil prices, calculated using the dynamic specification model by Engle and Granger.[1]

Long-run estimation results of hot-rolled ferritic coil prices

| Variable | Coef | Lag | P-value | Lower bound | Upper bound | |

|---|---|---|---|---|---|---|

| Intercept | 1.195 | 0.082 | -0.153 | 2.542 | ||

| Steel scrap | 0.138 | 2 | 0.000 | 0.070 | 0.206 | |

| PUN | 0.119 | 3 | 0.000 | 0.093 | 0.145 | |

| Extra-alloy AISI 430 | 0.201 | 0 | 0.000 | 0.152 | 0.250 | |

| Euro area consumer price index | 0.445 | 0 | 0.000 | 0.263 | 0.627 | |

| Euro area industrial cycle index | 0.209 | 0 | 0.048 | 0.002 | 0.416 | |

| Adjusted R²: 0.947 | ||||||

The long-run estimation results of the model’s explanatory variables show parameters consistent with economic theory and statistically significant.

The estimated coefficient of the steel charge, which is the sum of the coefficients for steel scrap and electricity, is 0.26, higher than that of the extra-alloy component at 0.20. Overall, the cost pass-through of the commodities used as production inputs is estimated at 0.46, which implies that, ceteris paribus, a 10% increase (or decrease) in raw material prices leads, on average, to a 4.6% increase (decrease) in hot-rolled ferritic coil prices.

The highest elasticity coefficient is that related to labor and service costs, with a value of 0.45, more than twice that between coil prices and the industrial cycle index, which is 0.21.

The estimated adjusted R2 is 0.95, out of a maximum of 1, indicating an excellent ability of the model to capture the long-run dynamics of hot-rolled ferritic coil prices.

Short-run regression

The following table reports the short-run estimation results of the Error Correction Model (ECM), which estimates the adjustment processes of the variables toward the “theoretical” long-term values.

Short-term estimation results of the prices of hot-rolled ferritic coils

| Variable | Coef | P-value | Lim inf | Lim sup | ||

|---|---|---|---|---|---|---|

| Intercept | 0.000 | 0.890 | -0.006 | 0.007 | ||

| Shock | 0.616 | 0.000 | 0.347 | 0.885 | ||

| Adjustment coefficient | -0.527 | 0.000 | -0.676 | -0.379 | ||

| Corrected R²: 0.324 | ||||||

The value of the initial shock is estimated at 0.62, which indicates that 62% of the variations in the price determinants are transmitted instantaneously to the price of ferritic coils. In subsequent periods, the correction of deviations from the long-term equilibrium values occurs with a relatively high adjustment speed, equal to 53% of the deviation from the previous period.

Conclusions

The estimates of the long-term coefficients for hot-rolled ferritic coils were consistent with economic theory and statistically significant.

The cost pass-through of the steel charge to the prices of ferritic coils is estimated at 0.26, slightly higher than the extralegal component, which is 0.20. These parameters differ significantly from the cost pass-through estimates for austenitic coils, where the elasticity with respect to the extralegal component is 0.48, almost double that of the steel charge, which is 0.25.

[1] For a more detailed explanation of the Engle and Granger model, see last week's article: Cost pass-through of hot-rolled austenitic coil prices