How tariffs reshape markets: the effect on commodity prices

Two transmission channels - macroeconomic and trade-related - explain the impact of protectionist tensions on global prices

Published by Pasquale Marzano. .

USA customs duties Import tariffsThe Trump administration’s announcement on April 2 regarding the introduction of new tariffs triggered strong reactions in financial markets, with immediate effects on various commodities. Although tariffs are intended as tools to protect domestic production sectors, their consequences extend beyond national borders, affecting global supply and demand dynamics. In particular, two distinct channels can be identified through which protectionist measures influence international commodity prices: a macroeconomic channel and a trade reallocation channel.

The macroeconomic channel: tariffs, global trade, and commodity demand

So far, the main focus of financial operators and media has been on this first channel. Tariffs imposed by the United States have fueled uncertainty and may slow international trade. A contraction in global trade acts as a drag on global economic activity, with depressive effects on aggregate demand, including demand for raw materials.

This fear was immediately reflected in stock markets, which recorded sharp declines in the days following the announcement. The effect was evident across global exchanges, with average losses of 10% in the first three days.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

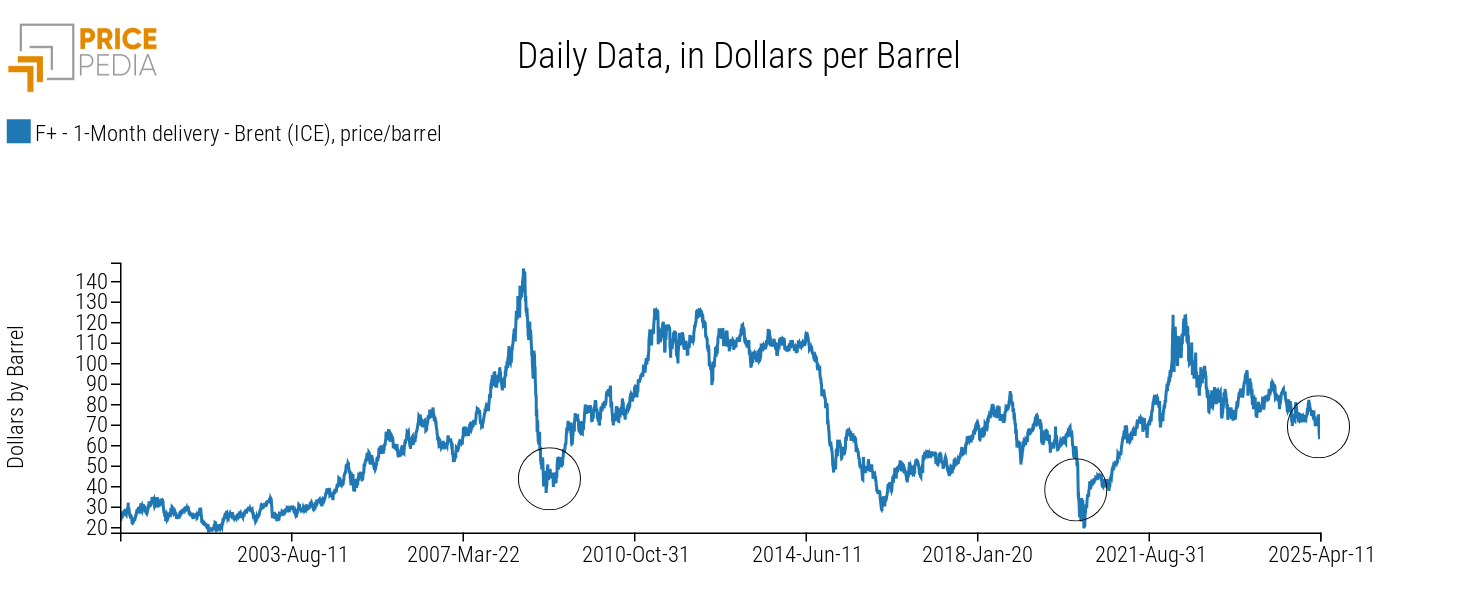

The impact was also felt in commodity markets, particularly oil: Brent crude prices plummeted within a few sessions, dropping from $75 per barrel on April 2 to $61 per barrel seven days later. This trend reflects market expectations of weaker future demand due to the anticipated global economic slowdown.

The chart below shows daily Brent prices throughout this century.

Daily Brent Oil Prices, Dollars per Barrel

Volatility is very high, with numerous periods of sharp oil price declines. However, if we focus on changes occurring over a three-day span - which more directly reflect financial market sentiment - the 15% drop recorded between April 2 and April 7 ranks among the three most significant three-day drops in recent history. The other two occurred in March 2020, following the COVID-19 pandemic announcement, and in December 2008, after the release of negative U.S. economic data following the collapse of Lehman Brothers in September of the same year.

The trade reallocation channel: sectoral effects and supply redistribution

A second, less immediate but equally important channel involves the restructuring of global trade flows. When the U.S. imposes tariffs on a specific commodity, imported goods become relatively more expensive than domestic ones. This favors domestic producers and penalizes foreign ones, often leading to a reduction in imports.

As a result, the quantities no longer exported to the U.S. flood other international markets, leading to an increase in global supply outside the U.S. This surplus tends to exert downward pressure on world prices of the affected commodity. The trade reallocation channel thus operates more gradually than the macroeconomic channel but can produce longer-lasting effects, especially in markets already marked by oversupply.

Two historical examples of the transmission of this latter channel involve the diverging price trends of steel and aluminum in U.S. versus international markets following the 25% tariff on steel and 10% tariff on aluminum introduced in 2018 by the first Trump administration. In both cases, in the months following the introduction of the tariffs, a positive price differential emerged between the U.S. market and the rest of the world.

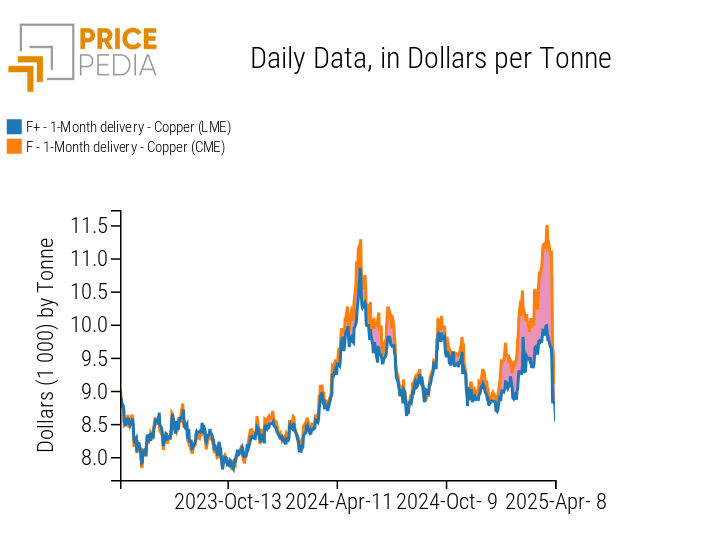

Further empirical evidence of this channel can be observed in copper prices, which are quoted both on the Chicago Mercantile Exchange (CME) - reflecting the U.S. market - and on the London Metal Exchange (LME) - reflecting the European market. As shown in the chart below, in anticipation of possible tariffs on U.S. imports, financial operators pushed CME quotes to diverge from LME quotes. The spread between the two markets progressively widened up to April 2, signaling expectations of significantly higher price increases in the U.S. physical market compared to the European one.

LME Copper vs CME Copper, Dollars per Tonne

After April 2, this differential quickly narrowed as copper was among the 1000 customs codes listed in Annex II, published on April 2, which details the products exempted from tariffs by the Trump administration. The potential exemption of imported copper thus led financial operators to drastically revise their expectations regarding a price divergence between the U.S. and European markets.

The case of copper highlights the importance of considering whether a commodity is included in Annex II. Those that are included (and thus exempt from tariffs), unless future measures are introduced, will likely only be affected by the macroeconomic channel. Those excluded, however, will be impacted by both the macroeconomic and trade reallocation channels. For the latter, a more pronounced price decline in international markets can be expected.

Conclusion

The recent wave of tariffs imposed by the United States has reignited attention on the interconnectedness of global markets and how trade policies can trigger cascading effects. While the macroeconomic channel explains the immediate reactions of financial markets and commodities most sensitive to global demand, the trade reallocation channel helps interpret subsequent adjustments linked to new international supply and demand balances.

If the trade war initiated by the Trump administration is not resolved soon, a significant decline in commodity prices can be expected in the coming months. Such declines are likely to be steeper for commodities directly affected by the new U.S. tariffs, as their consequences would be felt through both transmission channels: the macroeconomic and the trade reallocation channels.