From raw materials to markets: how prices are formed in basic petrochemicals

Naphtha, natural gas and tar: three routes converging in the large alkene and aromatic hydrocarbon markets.

Published by Luigi Bidoia. .

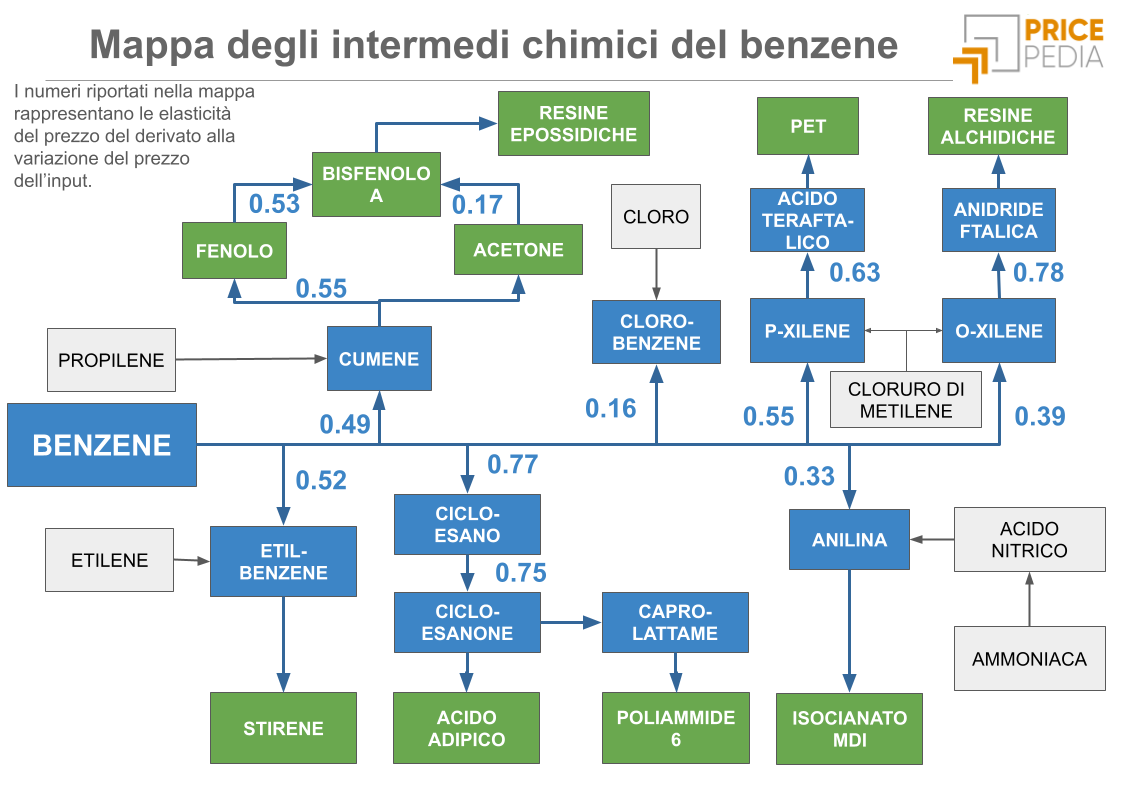

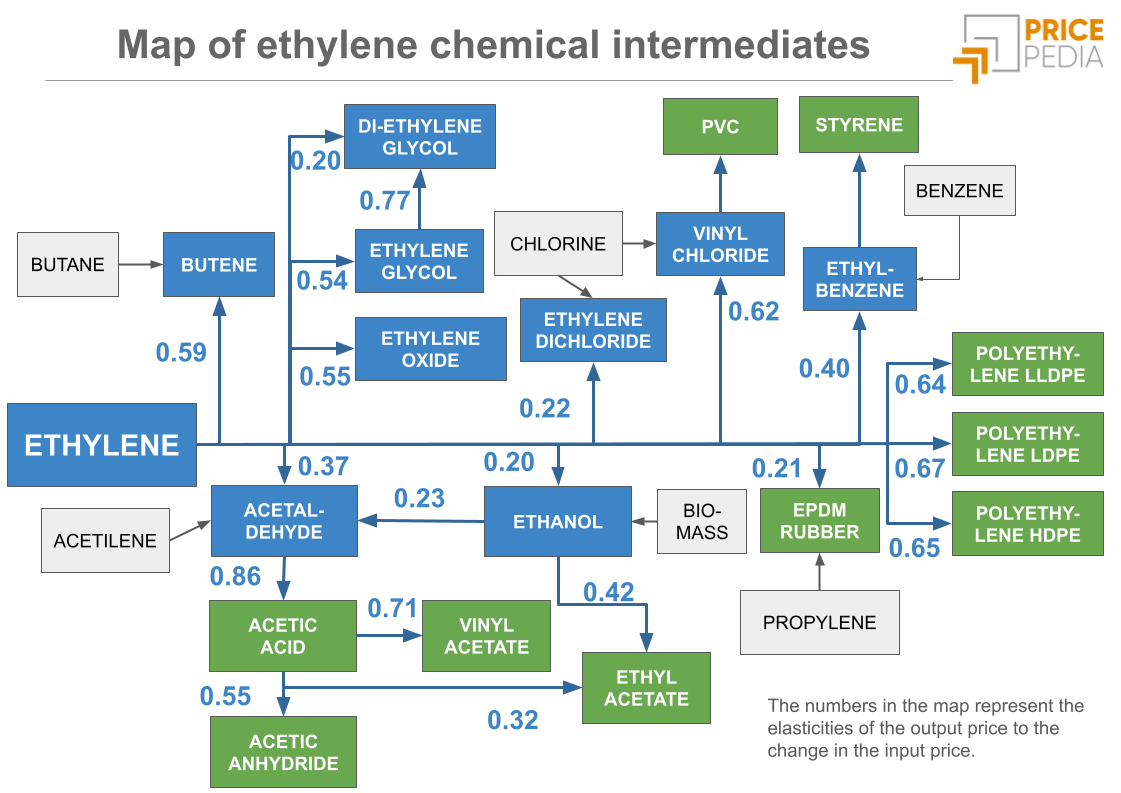

Organic Chemicals Petrolchimica Price DriversIf ethylene, propylene, and benzene are the fundamental pillars of the petrochemical industry — its building blocks — it is worth asking: where do these compounds come from? And more importantly, what determines their prices? To answer these questions, we need to look upstream in the value chain, toward the processes that convert raw materials like naphtha and natural gas into the key compounds of industrial chemistry.

Two major technological pathways dominate this part of the petrochemical industry:

- Steam cracking of light naphtha, ethane, propane, and butane, which produces olefins such as ethylene, propylene, butenes, and, to a lesser extent, other compounds like butadiene;

- Catalytic reforming of heavy naphtha and the fractional distillation of coal tar, which yield the so-called BTX aromatics: benzene, toluene, and xylenes.

These processes share the goal of producing reactive, versatile, and high-value molecules. The following diagram summarizes the various production processes.

Market Dynamics

Although these products originate from the same petrochemical processes, they do not share the same market dynamics.

In the case of ethylene, for example, international trade is limited due to high transportation costs, and the product is almost entirely consumed within the region where it is produced. As a result, the price of ethylene tends to reflect local feedstock and energy costs, leading to significant price differences between regions such as North America, Europe, and Asia.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Benzene, on the other hand, benefits from lower transportation costs and is subject to substantial international trade. This has led to the formation of a global reference price, which tends to align the prices of benzene produced from very different sources — such as virgin naphtha and coal tar — despite their differing production costs.

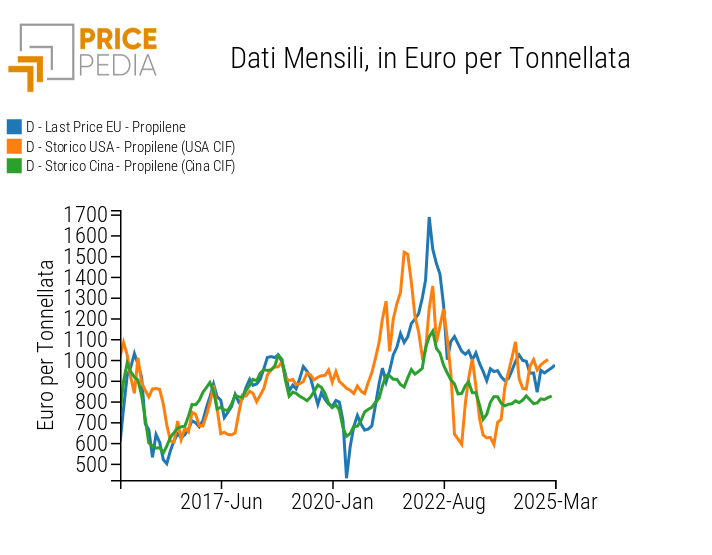

In this context, propylene represents an intermediate case: although it is largely consumed locally, there is enough international trade to generate partial price alignment across regions, even if it does not reach the same level of globalization seen in the benzene market.

As illustrated in the article Ethylene: Price Dynamics and Competitive Advantages Between the United States and Europe, the price of ethylene is significantly lower in the U.S. market compared to China and Europe, due to the competitive advantage of low natural gas prices in the United States.

Similarly, the regional nature of the propylene market results in differing price trends across the world, alternating between phases of alignment and strong divergence, as shown in the chart below.

Comparison of Propylene Prices Across Global Markets

The commodity homogeneity of olefins produced via steam cracking of either virgin naphtha or natural gas makes it difficult to determine whether, beyond regional differences, there are also price differences linked to the production process. In other words, for molecules such as ethylene and propylene, which are chemically identical regardless of the feedstock used, it is not possible to distinguish on the market the price of the product based on its origin.

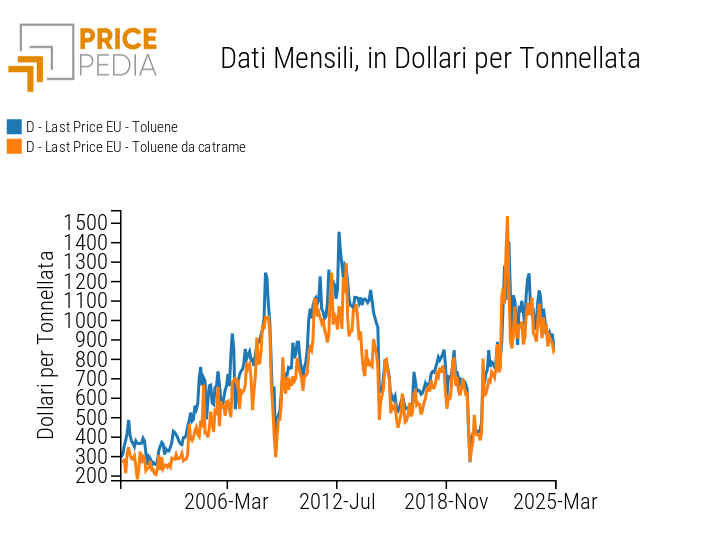

The situation is different for benzene, and more generally for BTX aromatics, where the commodity distinction between sources — namely, products obtained from naphtha through catalytic reforming and those derived from coal tar — is more pronounced. This difference mainly stems from the content of impurities (such as sulfur, nitrogen, and polycyclic compounds) and the presence of by-products that characterize coal tar-derived benzene. These factors influence the downstream applications of the product (e.g., purity requirements for the pharmaceutical industry or resin production) as well as refining or purification costs.

Despite these differences, the high level of integration in the global benzene market results in a single international reference price[1]. And precisely because of the distinction between the two sources, it is possible to observe how the price of benzene obtained from naphtha aligns closely with that derived from coal tar, even when the prices of the respective feedstocks follow different trajectories.

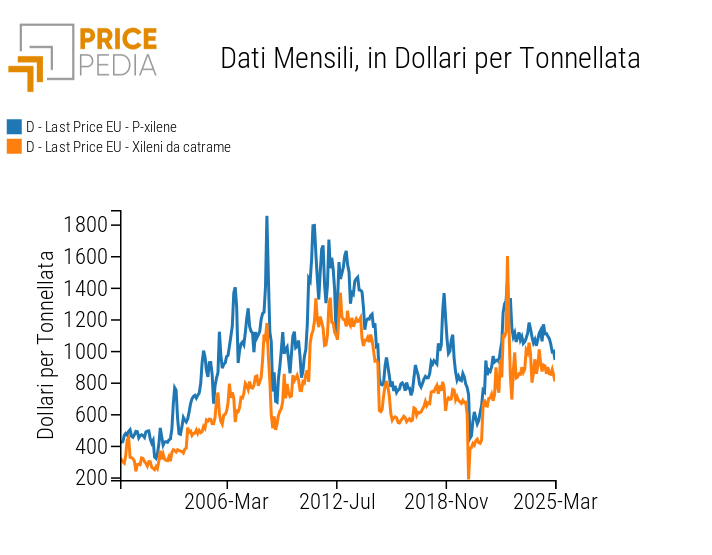

This phenomenon is not limited to benzene, but also extends to the other members of the BTX family, namely toluene and xylenes. The following two charts compare the prices of toluene and xylenes obtained from virgin naphtha with those derived from coal tar.

Comparison of prices of aromatics obtained from naphtha and tar

| Toluene | Xileni |

|

|

The price dynamics of the two product pairs are closely aligned, especially in the case of toluene. For xylenes, the alignment is slightly less pronounced but still clearly observable. This behavior confirms that, even for these products, the existence of a global reference price acts as a balancing force, leading to price alignment between products obtained through different production processes, despite variations in feedstock costs and industrial pathways. The price difference, which remains relatively constant over time, is not driven by cost disparities but rather by the technical and qualitative characteristics of the products resulting from the two processes.

Conclusion

Three major supply chains — fed respectively by naphtha, natural gas, and coal tar — converge at the core of the petrochemical industry to generate alkenic and aromatic hydrocarbons, which are among the most important intermediates in modern chemistry.

The varying ease of transportability of these products, along with the associated logistics costs, plays a crucial role in shaping market structures. In the case of olefins like ethylene and propylene, transportation challenges lead to the formation of regional markets, with price dynamics that can diverge significantly from one geographic area to another, mainly reflecting local feedstock and energy costs.

By contrast, aromatics are easier to transport and subject to broader international trade, placing them in a more globalized market where a single worldwide price tends to emerge. In this context, chemically identical products are traded at globally aligned prices, even if they are obtained from different feedstocks and production processes (such as benzene from naphtha or coal tar), regardless of their respective production costs. It is the market itself — through competition and arbitrage — that establishes this global balance.

For procurement professionals operating within the chemical and petrochemical sectors, understanding whether a market is regional or global represents a tangible competitive advantage. Knowing that ethylene pricing is driven by local feedstock and energy costs, while benzene follows global pricing dynamics, enables them to:

- develop more effective negotiation strategies by recognizing when there is room for bargaining and when prices are anchored to international benchmarks;

- anticipate future price movements based on structural changes in feedstock costs, logistics flows, or regional production configurations;

- assess alternative sourcing options and evaluate diversification strategies for their supply chain with greater awareness.

In a context shaped by volatility, energy transition, and shifting global flows, the ability to understand markets — not only for what they are, but for how they operate — is an increasingly essential strategic tool.

[1] See the article Benzene: A Global Price for a Strategic Supply Chain