Stickiness of bronze prices in the latest phase of price decline

Growth in tin prices has supported the dynamics of bronze

Published by Luca Sazzini. .

Tin Copper Non Ferrous Metals Price DriversBronze is a metal alloy made of copper and tin, with highly variable proportions depending on the desired properties. As the percentage of tin increases, bronze becomes harder, mechanically stronger, and more resistant to corrosion, but loses in malleability, workability, and conductivity. The most common type of bronze typically contains between 8-9% tin, but bronze alloys with less than 5% or more than 25% tin also exist. In the Daily Data Prices section of the Pricepedia website, the financial price of the CuSn9 alloy is published daily. This price is calculated as a weighted average of the LME copper and tin prices, with weights of 91% and 9%, respectively. If you are interested in monitoring daily financial prices of bronze with different tin percentages or with the addition of other metals, you can use the should cost tool, which allows you to build a weighted price index for the specific type of bronze of interest.

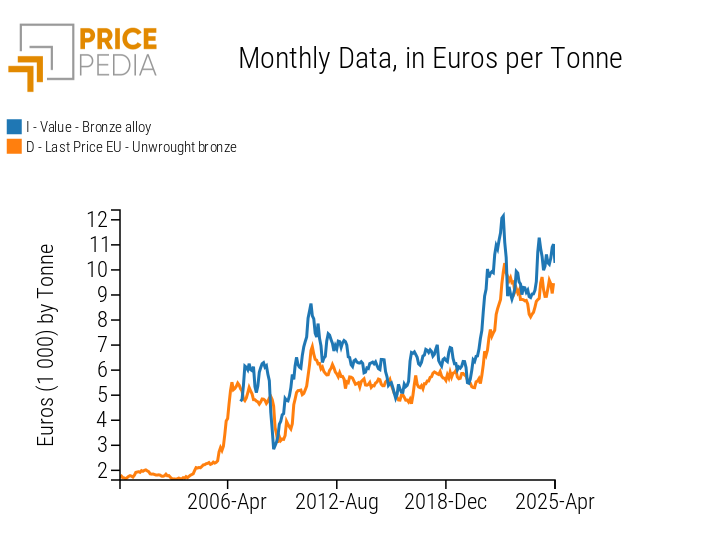

The following chart shows a comparison between the financial price of bronze and the customs prices of unwrought bronze recorded from trade among the 27 European Union countries.

Historical series of financial and customs prices of bronze, in euro/ton

The analysis of the chart highlights the stickiness of bronze prices during the recent price decline phase. After doubling in 2021 and the first part of 2022, both the customs and financial prices of bronze fell by 20% and 25%, respectively, during the second half of 2022 and in 2023. They then slightly increased in 2024 and stabilized around levels of 9,500–11,000 euros/ton.

Although bronze price trends are mainly driven by copper, recent high levels have also been influenced by a sharp increase in tin prices. Tin prices on the London Metal Exchange rose by more than a third from the end of 2024 to early April 2025. This increase is due to both rising demand — expected to grow by 11% in 2025 compared to 2019 levels — and, above all, a decrease in supply and its future outlook, caused by several factors, including:

- a drop in production in Indonesia, the world's second-largest producer of tin ore and ingots after China, along with the Indonesian government's decision to limit exports to encourage domestic investment in the tin value chain;

- uncertainty regarding the resumption of production in Myanmar (also known as Burma), the world's third-largest producer of tin ore, suspended since 2023 by decision of the militia controlling the Wa State (an autonomous region in northeastern Myanmar). Despite the announcement of a restart and the issuance of the first licenses in early 2025, the earthquake that hit Myanmar on March 28 may cause further delays;

- production suspension by Alphamin, which operates one of the largest tin mines in the Democratic Republic of the Congo, due to attacks by insurgent groups.

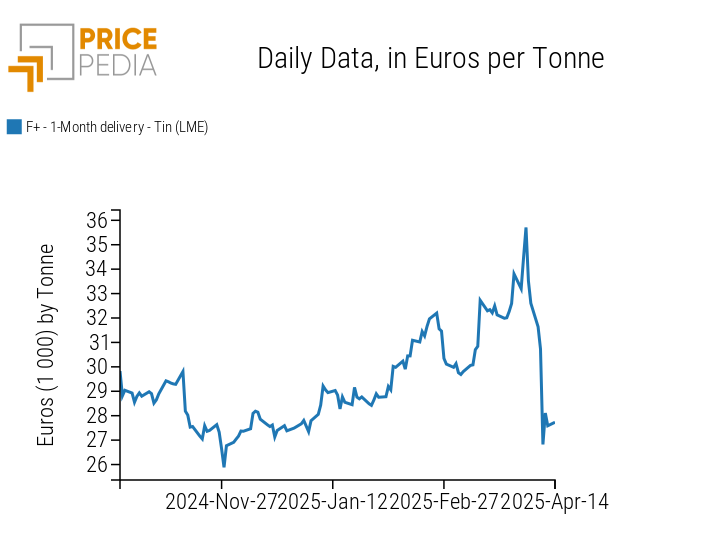

The following chart shows the trend of financial tin prices quoted on the London Metal Exchange (LME).

LME tin financial prices, in euro/ton

The chart analysis shows a sharp increase in tin prices between late November 2024 and early April 2025, rising from about 26,000 euros/ton to 36,000 euros/ton. However, following Trump’s tariff announcement on April 2, tin prices plummeted by 25% in a single week, falling back below 27,000 euros/ton. Therefore, unless another major market shock occurs, the support that tin provided to bronze prices up until March may no longer be present. In fact, despite the recent announcement of a 90-day suspension of reciprocal tariffs, the rebound in tin prices has been minimal compared to the drop experienced since April 2.

The support of bronze prices, driven by increases in LME tin, has indirectly affected the prices of its semi-finished products as well, such as plates. The following analysis will examine the price trends of bronze plates in recent years, comparing them with the trend of European customs prices for unwrought bronze, to assess whether plate prices have shown the same stickiness as bronze in the phase of price decline.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Price analysis of bronze plates

The table below shows the annual average prices of bronze and bronze plates, from early 2020 to the present. The last column also reports the cumulative percentage change over the period, to highlight their overall variation.

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | Cumulative % change | |

|---|---|---|---|---|---|---|---|

| D-Last Price EU-Unwrought Bronze | 5528 | 7182 | 9509 | 8731 | 9032 | 9327 | 68.72% |

| D-Last Price EU-Rolled Bronze Plates | 7769 | 10100 | 11638 | 11879 | 12408 | 12820 | 65.01% |

| D-Historical USA-Rolled Bronze Sheets (USA CIF) | 6890 | 9458 | 11102 | 10601 | 12345 | 14147 | 105.33% |

| D-Historical USA-Rolled Bronze Sheets (width < 500 mm) (USA CIF) | 7431 | 10282 | 12282 | 11664 | 12458 | 12574 | 69.21% |

| D-Historical China-Rolled Bronze Plates (China CIF) | 7911 | 10136 | 13081 | 11565 | 11793 | 12667 | 60.12% |

| D-Historical China-Rolled Bronze Plates (China FOB) | 7808 | 10264 | 13412 | 11463 | 11540 | 12648 | 61.99% |

With the exception of rolled bronze sheets in the USA, with a width greater than 500 mm, whose prices have more than doubled since 2020, all other types of plates show increases between 60% and 70%, in line with unwrought bronze.

From the analysis of customs price levels in the three geographical areas considered—European Union, United States, and China—similar price dynamics and levels are observed, currently standing at around 13,000 euros/ton, with slight variations depending on the price type, which may refer to alloys containing different percentages of copper and tin.

Conclusion

This analysis has highlighted a stickiness in the prices of bronze and bronze plates, whose levels have recently been supported by the rise in tin prices. Between November 2024 and March 2025, in fact, the price of tin rose by more than a third, driven by a contraction in supply and stronger demand. However, following the sharp drop in tin prices on April 2, caused by the new tariffs announced by Trump, this support may fade in the coming months.

The prices of bronze plates have followed a trend similar to that of unwrought bronze, with increases between 60% and 70% compared to average levels in 2020. The three geographical areas considered—European Union, United States, and China—show relatively aligned price levels, with limited differences that may reflect variations in the composition of the bronze alloy, particularly in the tin content, which can range from less than 5% to over 25%.