Price analysis of semi-finished brass products

Comparison of regional prices of brass bars, sheets, tubes and wires

Published by Luca Sazzini. .

Non Ferrous Metals Price DriversBrass is a metallic alloy composed of copper and zinc, with varying proportions depending on the desired properties. A higher copper content makes brass more corrosion-resistant, more malleable, and easier to work with. On the other hand, increasing the percentage of zinc enhances its hardness and tensile strength but reduces its malleability and corrosion resistance.

The trade of brass takes place exclusively in physical markets, in the form of industrial semi-finished products with varying characteristics and proportions based on their final use. As such, there are no public financial quotations on stock exchanges that allow daily monitoring of brass prices. However, it is possible to indirectly follow its price dynamics by combining the financial quotations of copper and zinc, in proportions consistent with the specific brass alloy being considered. For example, PricePedia publishes the daily price of Muntz metal, a brass alloy composed of 60% copper and 40% zinc.

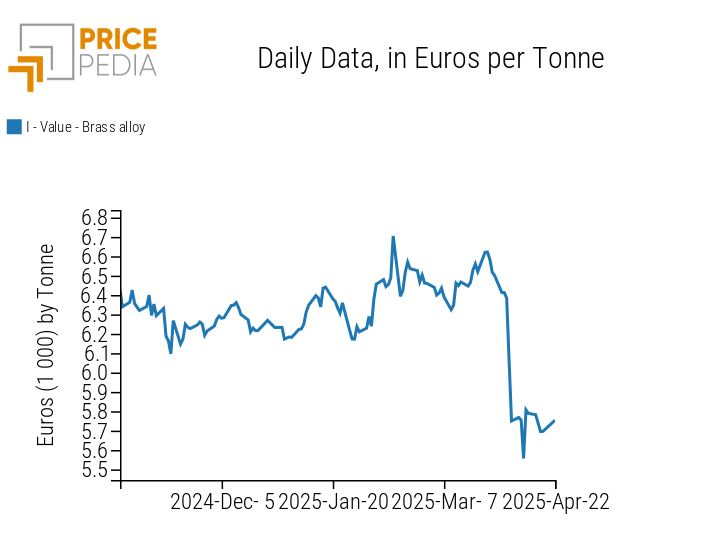

The following chart shows the daily historical trend over the past 6 months of the price of Muntz brass, calculated by combining the LME quotations of the two metals.

Historical series of financial prices of Muntz brass, in euros/ton

The chart analysis highlights a decline in Muntz brass prices in early April 2025, due to the crash in financial prices of copper and zinc following Trump's announcement to impose tariffs on imports from over 100 countries, in what was called "Liberation Day." The financial prices of Muntz brass fell from an average of nearly 6,500 euros/ton in March to about 5,800 euros/ton, marking a variation of around -10%.

Although the combination of copper and zinc financial prices provides a useful tool for analyzing the daily price dynamics of brass, if one wishes to monitor the behavior of a specific semi-finished product, it becomes necessary to refer to physical prices, which can be obtained from customs flow data published by various countries.

This article focuses on the analysis of four brass semi-finished products: bars, sheets, tubes, and wires, comparing the prices recorded in the customs declarations from the following geographical areas: the European Union, the United States, and China.

Price Analysis of Brass Bars

Brass bars are mainly used in precision machining thanks to their excellent workability. Their ease of turning, milling, and threading makes them ideal for manufacturing components such as screws, pins, bushings, gears, and fittings, primarily used in the mechanical, hydraulic, and electrical sectors, where a combination of precision and strength is required.

Below is the trend of annual average customs prices of brass bars, expressed in euros/ton.

Table of brass bar prices, in euros/ton

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|---|

| D-Last Price EU-Brass bars | 4277 | 5739 | 6751 | 6231 | 6257 | 6368 |

| D-Historical USA-Brass bars (and rods) (USA CIF) | 4865 | 6386 | 8173 | 7999 | 8402 | 8521 |

| D-Historical USA-Brass bars (profiles) (USA CIF) | 5947 | 7019 | 9535 | 8893 | 9209 | 10470 |

| D-Historical USA-Brass bars (rectangular section) (USA CIF) | 5166 | 6745 | 8590 | 7771 | 7882 | 8461 |

| D-Historical China-Brass bars (straightness <0.5 mm/m) (China CIF) | 4568 | 5454 | 6673 | 6372 | 6415 | 7134 |

| D-Historical China-Brass bars (straightness <0.5 mm/m) (China FOB) | 4670 | 6362 | 7728 | 6800 | 6523 | 7596 |

| D-Historical China-Brass bars (straightness >0.5 mm/m) (China CIF) | 3996 | 5302 | 6676 | 6133 | 6364 | 6563 |

| D-Historical China-Brass bars (straightness >0.5 mm/m) (China FOB) | 5245 | 6672 | 8266 | 7041 | 7172 | 7802 |

The analysis of annual average customs prices for brass bars shows a common trend across regions. Except for Chinese exports of bars with straightness below 5 mm, which show a price decline in both 2023 and 2024, there is a general upward trend from 2020 to 2022, followed by a drop in 2023 and a subsequent recovery in 2024 and the early months of 2025.

The level analysis reveals slightly higher prices on the US market compared to those in China and Europe. In particular, the highest price is recorded for bars with profiles other than hollow ones, which reached €10,000/ton at the start of 2025—over €1,500/ton higher than other US prices and about €3,000–4,000/ton higher than prices in the Chinese and European markets.

Analysis of Brass Sheet Prices

Brass sheets are used in the production of connectors, terminals, electrical components, plating and protective coatings, especially in the electronics and automotive industries.

The following table shows the annual average prices of brass sheets traded in the European, US, and Chinese markets.

Table of brass sheet prices, in euros/ton

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|---|

| D-Last Price EU - Rolled brass sheets | 5487 | 7061 | 8021 | 8129 | 8356 | 8693 |

| D-Historical USA - Rolled brass sheets (thickness < 1.6 mm) (USA CIF) | 5531 | 7480 | 8804 | 8373 | 8415 | 9123 |

| D-Historical USA - Rolled brass sheets (thickness < 5 mm) (USA CIF) | 5811 | 7352 | 9147 | 11236 | 10905 | 11675 |

| D-Historical USA - Unrolled brass sheets (USA CIF) | 6681 | 7502 | 9753 | 9111 | 9789 | 10355 |

| D-Historical China - Rolled brass sheets (China CIF) | 5753 | 7453 | 8846 | 8166 | 8519 | 8929 |

| D-Historical China - Rolled brass sheets (China FOB) | 5219 | 6973 | 8208 | 7258 | 7624 | 7969 |

The analysis of brass sheet price dynamics highlights that, in recent times, the discrepancy between regional brass sheet prices has increased. While in 2021 the maximum spread between sheet prices was below 600 euros/ton, by early 2025 this gap has widened to 3700 euros/ton. US prices have shown greater increases compared to those observed in the Chinese and EU markets. Starting from relatively similar levels, from 2021 to the present, Chinese and European brass sheet prices have risen by between 1000 and 1500 euros/ton, whereas in the US market prices have increased by 2000 to 4000 euros/ton, depending on the specific sheet type considered.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Brass Tubes Price Analysis

Brass tubes are mainly used in plumbing systems, heating systems, and air conditioning circuits due to their corrosion resistance and good workability. An overview of their prices across various regional markets is shown in the table below.

Table of brass tube prices, in euros/tonne

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|---|

| D-Last Price EU-Brass Tubes | 5176 | 6515 | 7910 | 7655 | 7656 | 7875 |

| D-Historical USA-Brass Tubes (USA CIF) | 7132 | 8578 | 11308 | 10619 | 9953 | 10868 |

| D-Historical USA-Brass Fittings (USA CIF) | 8500 | 9456 | 12314 | 11276 | 11431 | 11410 |

| D-Historical China-Brass Tubes (China FOB) | 6657 | 8366 | 10061 | 8930 | 9189 | 9269 |

After the price increase between 2020 and 2022, brass tube prices have stabilized at levels significantly higher than those of 2020.

Price level analysis shows that prices in the US market are slightly higher than those in Europe and China. Additionally, the US market shows a premium of around 1000 euros per tonne for threaded fittings compared to seamless brass tubes.

Brass Wires Price Analysis

Brass wires are used in the production of cables, connectors, and other electrical components thanks to their excellent strength and good electrical conductivity.

The table below shows the price trends of brass wires in the European, US, and Chinese markets from 2020 to the present.

Table of brass wire prices, in euros/tonne

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|---|

| D-Last Price EU-Brass Wires | 5813 | 7385 | 8679 | 8152 | 8415 | 8597 |

| D-Historical USA-Brass Wires (USA CIF) | 6792 | 8311 | 10313 | 9130 | 9404 | 10236 |

| D-Historical China-Brass Wires (China FOB) | 5353 | 7021 | 8173 | 7325 | 7655 | 8074 |

The table analysis reveals a general trend in brass wire prices, with growth from 2020 to 2022, followed by a decline in 2023, and then a renewed increase in 2024 and the first months of 2025.

Price levels in Europe and China appear to be nearly identical, whereas the US market shows a premium of around 2000 euros/tonne from early 2025 to date.

Conclusions

Prices of brass semi-finished products tend to follow similar pricing dynamics, with relatively close levels that may differ depending on product specificity and regional markets.

For all four brass semi-finished products analyzed in this article, higher price levels have been observed in the US market compared to those recorded in the EU and Chinese markets.

The price dynamics analysis indicated that for rods, wires, and especially brass sheets, the discrepancies between regional prices in the US and those in the EU and China have increased in recent years. The most evident case is that of brass sheets, where the maximum spread between prices from 2021 to today has grown from 600 euros/tonne to 3700 euros/tonne.