The Ammonia Industry and Its Derivatives

An Econometric Analysis of Cost Pass-Through Along the Ammonia Supply Chain

Published by Luigi Bidoia. .

Inorganic Chemicals Cost pass-throughAmmonia is one of the main building blocks of inorganic chemistry. Global production is estimated at around 150 million tons per year. Its molecule (NH3) is composed of one nitrogen atom and three hydrogen atoms.

Ammonia and Fertilizers

Ammonia plays an essential role in global agricultural systems through its use in fertilizer production. The main types of chemical fertilizers are distinguished based on the primary nutrient they supply to plants:

- nitrogen (nitrogen fertilizers), essential for plant growth;

- phosphorus (phosphate fertilizers), important for root development and flowering;

- potassium (potash fertilizers), crucial for plant resistance and fruit quality.

Ammonia serves as the starting point for all mineral nitrogen fertilizers. About 70% of global ammonia production is allocated to this use.

The remaining 30% of ammonia is used in various industrial applications, including the production of plastics, explosives, and synthetic fibers.

Ammonia as a Hydrogen Carrier

Currently, the use of ammonia as a hydrogen carrier is still marginal, although its potential is very high within the context of the energy transition. Hydrogen carriers are substances that form bonds with hydrogen atoms, from which hydrogen can later be released through chemical reactions, making it available for use in fuel cells or other energy processes.

Among the main hydrogen carriers are ammonia, toluene, and methanol. Compared to these, ammonia offers two key advantages: a higher hydrogen (H2) density and the absence of CO2 emissions during hydrogen release.

Ammonia Production and CO2 Emissions

Global ammonia production is heavily dependent on fossil fuels. Just over 70% of ammonia is produced through steam reforming of methane, while the remaining part comes from coal gasification. Ammonia production is highly emission-intensive: for every ton of ammonia produced, between 1.6 and 2.6 tons of CO2 are generated, depending on whether the primary source is methane or coal. These values are roughly double those associated with crude steel production and four times higher than those for cement. Moreover, ammonia also causes indirect CO2 emissions due to the chemical reactions that occur when ammonia-based fertilizers are applied to soils.

Due to its high environmental footprint, ammonia production with current processes is not sustainable. Lower-emission production methods are available, but they involve higher costs. This situation creates a significant price risk, with the possibility of strong reductions in the event of a demand drop, but also the potential for sharp increases if supply shifts towards more sustainable but more expensive production technologies.

To limit the competitive advantage of non-EU producers in the European market, ammonia has been included among the goods covered by the EU's CBAM (Carbon Border Adjustment Mechanism). This regulatory mechanism aims to align production costs between EU products and extra-EU imports, encouraging more sustainable production even in third countries. CBAM will officially enter into its final phase on January 1, 2026.

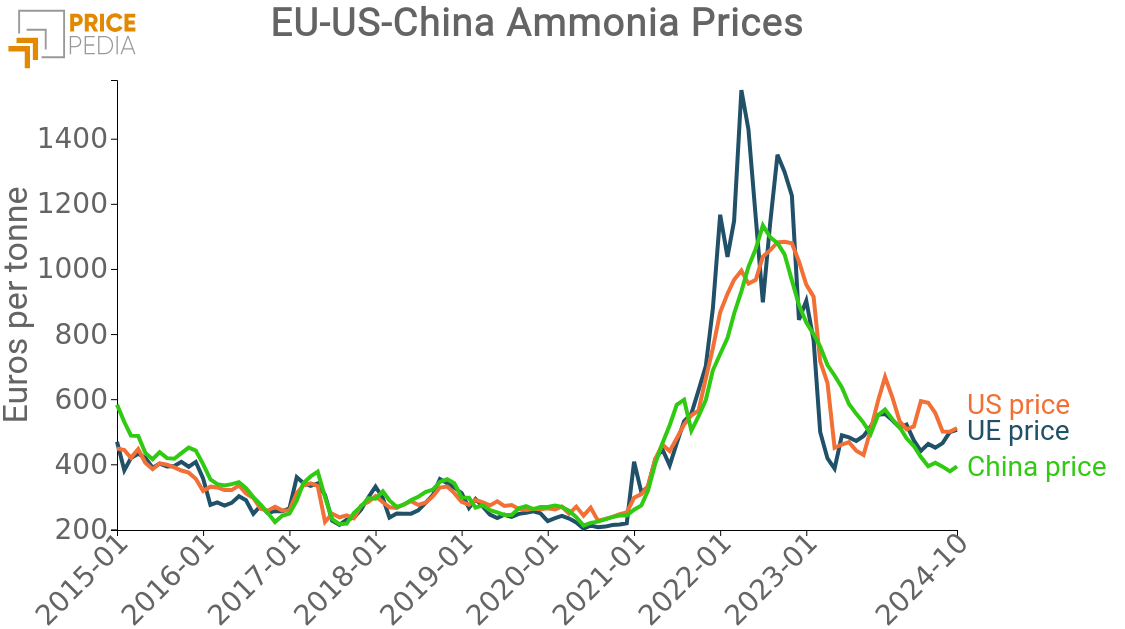

Global Market Structure and Single Global Price

The relative ease of transporting ammonia has supported its international trade, reaching a peak of 20 million tons of global demand in 2018, equivalent to 13% of global ammonia production. Among the major building blocks of the chemical industry, ammonia, together with benzene, is the product with the highest share of production destined for export markets. However, in recent years, first the pandemic crisis and then the sanctions against Russia have led to a reduction in global ammonia trade, estimated at around 15 million tons in 2024.

The high share of international trade has contributed to the formation of a single global market, with a homogeneous price across different areas, as illustrated in the article Ammonia in the global market: trade and price dynamics.

Cost Pass-Through of Ammonia Prices

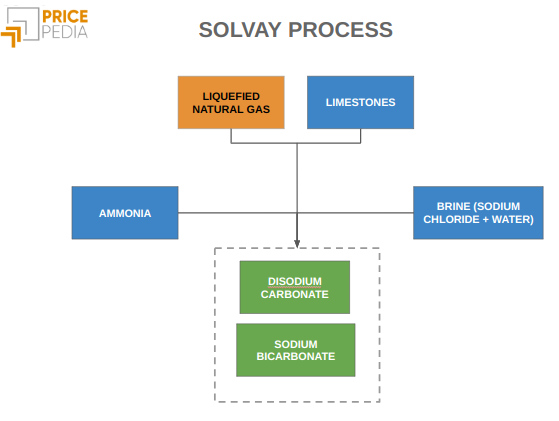

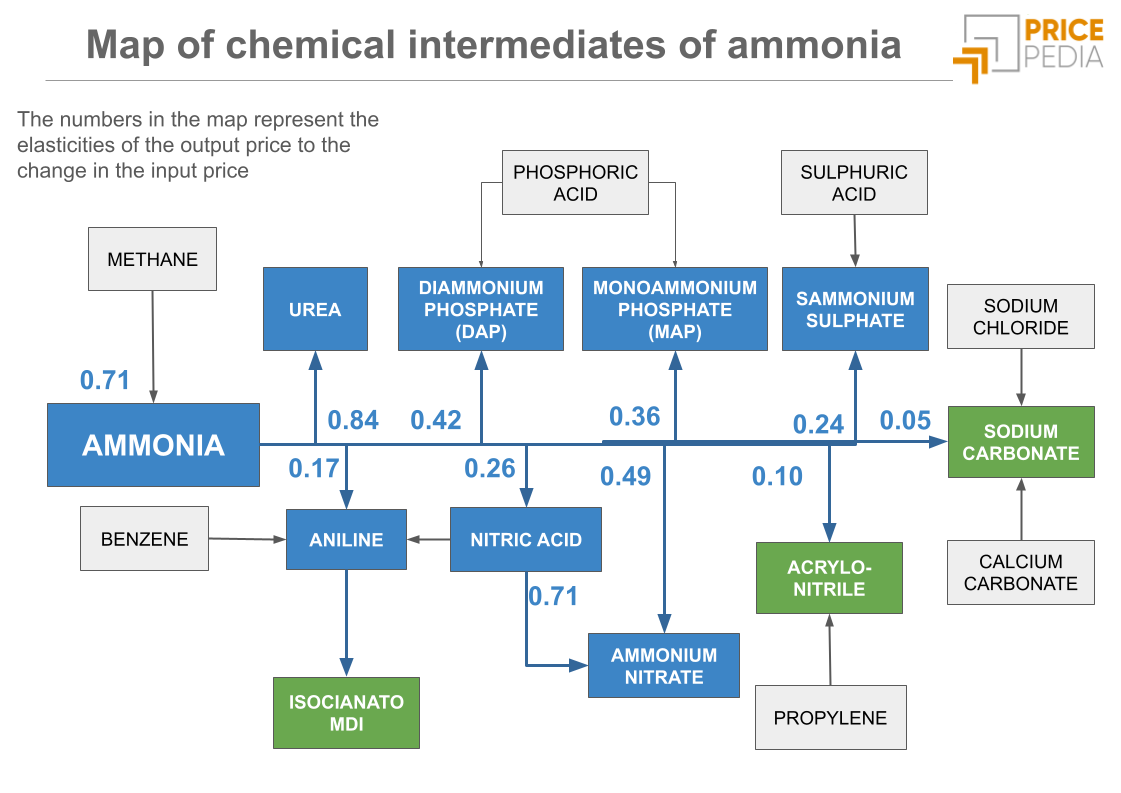

The following diagram shows the production chain map based on ammonia as the raw material. Its main use is in the production of nitrogen-based fertilizers: urea, diammonium phosphate (DAP), monoammonium phosphate (MAP), ammonium nitrate, and ammonium sulfate. Combined with benzene, ammonia is also used to produce aniline, a chemical intermediate employed in the manufacture of numerous compounds, including methylene diphenyl diisocyanate (MDI). When combined with propylene, ammonia is used as an input in the production of acrylonitrile, a key raw material for synthetic fibers, plastics, and rubber. Finally, ammonia is essential in the Solvay process for the production of sodium carbonate.

The map not only represents the supply chain links among the various chemical products but also provides an important economic insight: the price elasticity of each derivative relative to the price of ammonia. The numerical values indicate how much the price of the compound varies in response to changes in the price of ammonia. For example, the value 0.42 associated with diammonium phosphate means that a 10% change in the price of ammonia results in a 4.2% change in the price of DAP.

The analysis of the elasticities shown in the map highlights the importance of ammonia prices in determining the price of urea. Significant effects are also observed for other fertilizer raw materials. Conversely, the price of ammonia has a more marginal impact on the prices of aniline, acrylonitrile, and especially sodium carbonate. Although ammonia is fundamental to the Solvay process, its price has a limited impact on sodium carbonate production costs, since most of the ammonia used is recovered as a by-product and recycled back into the process.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Summary

Ammonia is one of the main building blocks of the chemical industry. Over the course of this century, global ammonia trade progressively increased until 2018, creating the conditions for a global market with a single reference price.

Ammonia plays a crucial role in the production of nitrogen fertilizers, significantly influencing their prices. Although it is also used as an intermediate in many other chemical processes, in many cases its impact on production costs is limited.

The chemical composition of ammonia (NH3) makes it a potentially key element in the energy transition as a hydrogen carrier.

In the near future, ammonia prices could undergo significant changes: on one hand, demand could decrease due to the limited environmental sustainability of current production methods; on the other hand, production costs could rise with the adoption of more sustainable but also more expensive technologies.