Effects of trade tariffs on aluminium prices

Financial markets are already discounting the entry into force of U.S. duties on aluminium

Published by Luca Sazzini. .

Aluminium USA customs duties Import tariffsIn the article: The steel trade war: from 2018 to the new phase of 2025, the possible effects of the introduction of US tariffs on steel prices were analyzed, retracing the effects that emerged during the first trade war of 2018 initiated by President Donald Trump.

In this article, we will conduct a similar analysis on aluminium prices to anticipate the possible consequences on global prices resulting from the introduction of US tariffs on aluminium.

Analysis of the current trade war and possible effects on aluminium prices

Tariffs on US aluminium imports

On February 10, 2025, President Donald Trump announced the introduction of 25% tariffs on aluminium imports into the United States, applicable to all countries, effective from March 12, 2025.

From a theoretical perspective, these tariffs should, all else being equal (ceteris paribus), lead to an increase in aluminium prices in the United States and a reduction in prices on international markets. This effect occurs because import restrictions reduce the inflow of aluminium into the US market, limiting its supply in the US and thus driving prices up. At the same time, the reduction of aluminium exports to the US market will encourage exporters to redirect their flows to other international markets, increasing global supply and exerting downward pressure on global aluminium prices.

The EU blocks imports of primary aluminium produced in Russia

On February 19, 2025, the European Union announced the sixteenth package of sanctions against Russia, as part of punitive measures in response to the invasion of Ukraine.

The main novelty announced in this package is the total ban on European imports of Russian primary aluminium. Until now, Europe had not yet adopted this punitive measure against Russia to avoid a price increase in the EU market. This restriction was finally introduced by the European Union after it had significantly reduced its dependence on Russian aluminium imports in recent years, partly thanks to the recent decline in domestic demand.

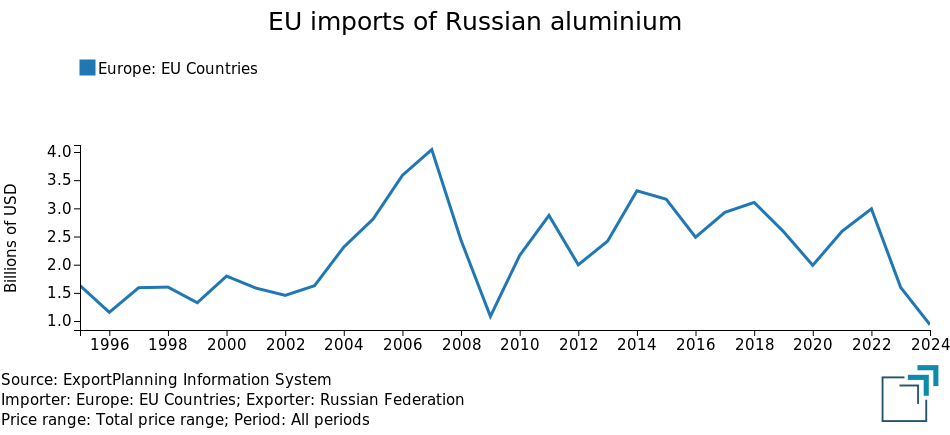

The following graph illustrates the historical series of EU aluminium imports from Russia.

EU aluminium imports from Russia

The graph analysis reveals a sharp decline in EU imports of Russian aluminium over the last decade. In 2015, the European Union imported over one and a half million tonnes from Russia; by 2022, the year of Russia’s invasion of Ukraine, these imports had fallen below one million tonnes, reaching less than half a million in 2024. This clear trend of reducing Russian supplies has made the EU increasingly autonomous and independent. As a result, the new ban on imports of aluminium produced in Russia will have a smaller impact on internal prices than it would have in the past when the European Union was much more dependent on Russian supplies.

Countermeasures adopted by the EU in the 2018 trade war

During his first term, President Donald Trump had already introduced 25% and 10% tariffs on US imports of steel and aluminium, invoking the National Emergency Act. The aim was to protect domestic industry and reduce US dependence on foreign supplies.

In response to the tariffs introduced by the US, the European Union had adopted protective measures on both steel[1] and aluminium.

In the case of aluminium, the EU had introduced additional tariffs of up to 25% on imports from the United States of finished or semi-finished aluminium products through the Implementing Regulation 2018/724.

Additionally, the EU had also introduced prior Union surveillance on aluminium imports to ensure that the European industry was adequately protected from harmful trade practices, such as the oversupply resulting from Chinese exports, which had destabilized the European internal market since the 2000s.

However, unlike the measures adopted by the United States, the European Union had introduced additional tariffs only on finished and semi-finished aluminium products, but not directly on raw aluminium. As a result, raw aluminium prices in the EU remained on average lower than those in the US market.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Price effects of the previous trade war

To assess the possible effects of the tariffs introduced by the Trump administration, it may be useful to examine what happened in the past following the 2018 trade war.

The following table shows the variation in aluminium prices from March 2018 to December 2024, for four different indices:

- US secondary aluminium producer prices: chosen as a proxy for the primary aluminium producer price in the US market;

- EU aluminium producer prices: a measure of the price increases applied in the EU market by European aluminium-producing companies;

- EU customs prices of unalloyed raw aluminium: representing changes in aluminium prices observed in EU customs trade;

- FOB export prices of Chinese unalloyed raw aluminium: representing changes in aluminium prices applied by Chinese companies in foreign markets.

Aluminium Price Variations in the USA, EU, and China

| Effective Period | Period Variation | |

|---|---|---|

| USA Secondary Aluminium Production Prices | 2018-03 - 2024-12 | +67.97% |

| EU Aluminium Production Prices | 2018-03 - 2024-12 | +34.47% |

| EU Customs Prices of Unalloyed Raw Aluminium | 2018-03 - 2024-12 | +44.76% |

| Chinese Export FOB Prices of Unalloyed Raw Aluminium | 2018-03 - 2024-12 | +34.11% |

The table analysis highlights the impact that US tariffs have had on primary aluminium prices. The US market has experienced a production price increase nearly twice as high as that recorded in the European market.

Furthermore, it is noteworthy that the increase in Chinese export prices of unalloyed raw aluminium has been lower, rising by only 34% since March 2018—more than 10% less than the growth recorded in Europe and over 30% less than the increase in US production costs.

Effects of 2025 Tariffs on Financial Prices

The introduction of customs tariffs not only affects the physical prices of individual regional markets but also has a significant impact on financial market prices. However, unlike physical prices, financial prices tend to anticipate the future effects of tariffs. Specifically, the financial prices of aluminium listed on the Chicago Mercantile Exchange (CME) are already incorporating the expected price increase due to the implementation of US tariffs on aluminium imports, which are set to take effect on Wednesday, 12 March 2025, unless the Trump administration reconsiders.

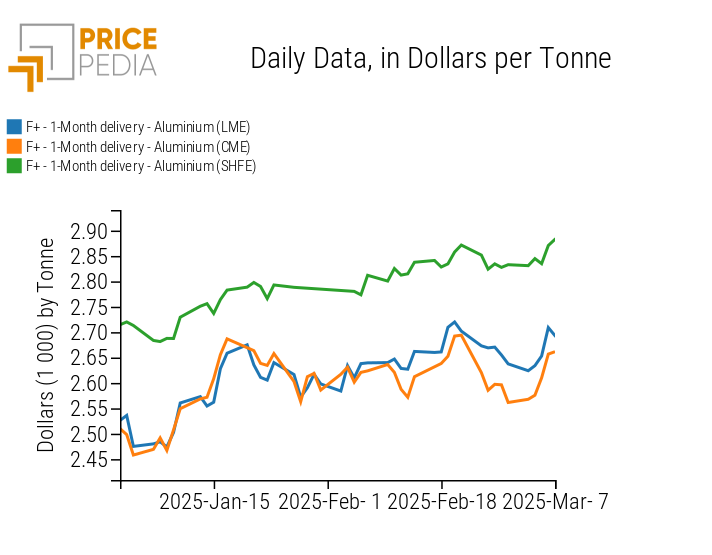

The following chart shows the historical trend of aluminium financial prices listed on the Chicago Mercantile Exchange (CME), compared with those of the other two major global financial benchmarks: the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE).

Comparison of Aluminium Financial Prices, Expressed in $/Ton

On Friday, March 7, the closing price of CME aluminium stood at $2,662 per ton,

marking a 4% increase compared to the previous Friday's price of $2,562 per ton.

This weekly growth is significantly higher than that observed on the London and Shanghai exchanges,

which recorded increases of 2% and 1.8%, respectively.

Financial traders are therefore increasingly purchasing aluminium quoted in Chicago,

betting that, following the tariffs announced by President Trump,

they will be able to resell it at a higher price and secure a profit.

Conclusions

The introduction of new tariffs by the Trump administration, all else being equal,

will lead to higher prices in the U.S. market and lower prices internationally.

This effect is already emerging in the financial prices of aluminium traded in Chicago,

which have risen 2% more than those on the London and Shanghai exchanges.

In the U.S. market, it is likely that the new tariffs will drive even greater price increases than in the past,

as the 25% tariff on aluminium imports is more than double the 10% imposed during Trump's first term.

In Europe, a similar approach to the previous one is expected,

with tariff increases mainly on finished and semi-finished aluminium products.

At present, a rise in tariffs on raw aluminium seems less likely,

especially considering that in its latest sanctions package against Russia,

the EU has already completely banned imports of primary Russian aluminium.

[1] For detailed information on the steel tariffs adopted by the European Union in response to US tariffs, see the article: Chinese steel prices have never been so low